What is Hyperliquid and why does it matter

9 min read

- Ethereum

- Altcoins

Hyperliquid emerged as one of the most talked-about projects in DeFi, and beyond, for its attempt to combine exchange-grade performance with on-chain decentralisation.

Touted as the first DEX to embody Satoshi Nakamoto’s principles, Hyperliquid runs on its native token, $HYPE, whose rapid appreciation brought it into the top 20 cryptocurrencies at the time of writing.

But the exchange is only one part of the picture: Hyperliquid is also a Layer-1 blockchain, presented by its founders as next-generation infrastructure for global finance.

A DeFi network built by traders, for traders

The project was launched in May 2022 by a team of just eleven people, as co-founder Jeff Yan explained in an interview with the TBPN podcast in August 2025. “At the time, DeFi was still experimental”, he recalled. “Most products were bad, and we thought we could do it better.”

The collapse of FTX only strengthened their conviction that the market needed a truly decentralised, peer-to-peer, self-custodial exchange. That vision became Hyperliquid, a platform that reported significant revenue over the past year. Instead of raising funds through an ICO, Hyperliquid followed Bitcoin’s ethos. No venture capital firms were involved, and no one could purchase tokens before the launch.

“Hyperliquid has a crypto-native approach,” explained Yan to the TBPN podcast. “It’s a neutral protocol - one that truly belongs to the community.”

In February 2023, Hyperliquid launched its closed alpha mainnet, attracting around 4,000 users and offering 28 trading pairs. The network went fully live in August that same year.

Since then, Hyperliquid has attracted over 820,000 users and processed more than $231 billion in deposits, ranking as the third-largest decentralised exchange, behind PancakeSwap and Uniswap.

Originally designed exclusively for perpetual futures trading, the team soon realised that Hyperliquid had the potential to become the foundation of an entirely new financial ecosystem.

“Our ambition is unlimited,” said Jeff Yan. “We’re building something that can ultimately host all of finance. Hyperliquid is a blockchain, not just an exchange.”

Today, the protocol thrives on community-driven growth, a model of decentralised virality where traders themselves have become the project’s most powerful advocates.

Tokenomics designed for the community

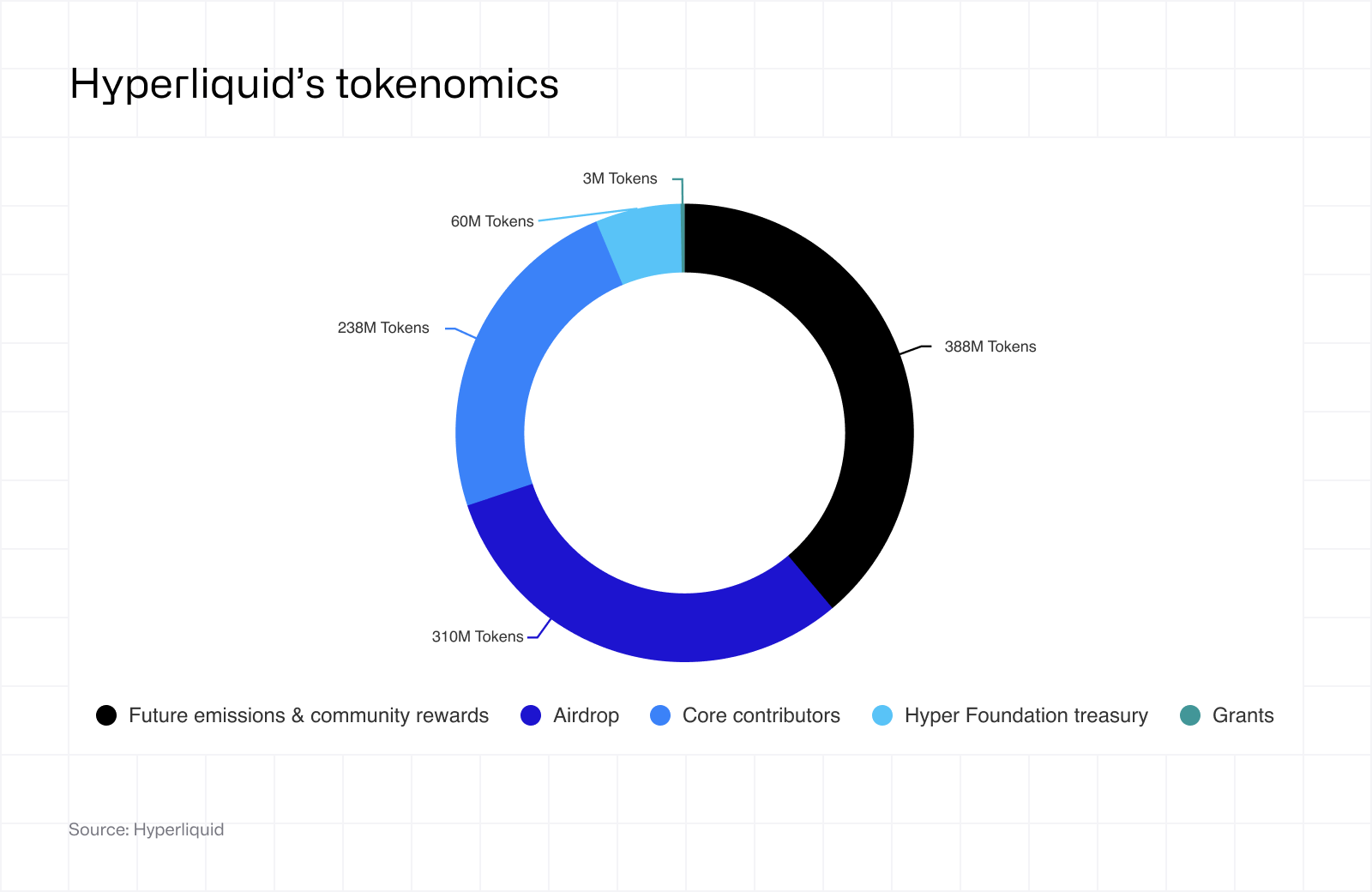

In November 2024, Hyperliquid made global headlines with an airdrop, distributed based on trading activity and early community participation and worth $1.6 billion at that time, one of the largest token launches in crypto history.

The airdrop reflected the founders’ philosophy of putting the community at the centre to achieve genuine decentralisation

As of November 2025, approximately 270.8 million $HYPE tokens are in circulation, out of a fixed one billion supply cap, giving the project a market capitalisation of around $10.7 billion.

A key element of Hyperliquid’s success is its aggressive buy-back strategy, which directs about 97% of collected fees toward supporting $HYPE’s price.

Hyperliquid currently accounts for nearly half of all token buy-backs in 2025, according to CoinGecko. It’s among the highest reported across major projects. As of mid-October, it had repurchased over 21.36 million HYPE tokens, worth about $644.6 million. The second-largest buyer, LayerZero, spent roughly $150 million, just a quarter of Hyperliquid’s total.

Some critics, however, argue that such buy-backs front-load demand rather than create lasting value. They caution that unless user activity and ecosystem fundamentals continue to grow at the same pace, the mechanism alone may not be sufficient to maintain long-term price stability.

The birth of HyperEVM

Hyperliquid opened a new chapter in February 2025 with the introduction of HyperEVM. This major upgrade makes the network fully compatible with the Ethereum Virtual Machine (EVM), marking a shift from a pure exchange layer to a programmable Layer 1 ecosystem.

One of the first visible changes is the ability to transfer the HYPE spot token onto HyperEVM, where it now functions as the native gas token.

This integration allows developers to deploy Ethereum-compatible smart contracts with significantly enhanced performance, directly linking DeFi applications to Hyperliquid’s core matching engine.

By combining a low-latency order book with general-purpose smart contracts, Hyperliquid has evolved beyond a traditional decentralised exchange. It now functions as a comprehensive Layer-1 financial infrastructure, designed to host lending markets, structured products, synthetic assets, and advanced DeFi protocols within a seamless, composable ecosystem.

Regulatory challenges and centralisation concerns

As Hyperliquid expands, it faces both regulatory and structural risks. The implementation of MiCA in Europe and new U.S. rules on synthetic derivatives could reshape the compliance landscape for decentralised trading.

From a technical standpoint, integrating a high-frequency order-book exchange with an EVM-compatible Layer-1 chain introduces significant coordination and security challenges.

Centralisation remains one of Hyperliquid’s key structural risks. The network currently operates with 24 validators, which, though not directly controlled by developers, remain highly concentrated.

In its early stages, Hyperliquid also relied on external stablecoins such as USDC, bridged from other networks, primarily Arbitrum and Ethereum, creating a potential single point of failure.

The bridge was governed by a small validator set and upgradeable contracts, concentrating trust in a few operators. Users depositing USDC received wrapped tokens on the Hyperliquid blockchain, effectively a redeemable claim dependent on the bridge administrators.

This dependence began to ease with the launch of USDH, Hyperliquid’s native stablecoin, last September. By issuing stablecoins on-chain, USDH reduces reliance on external custodians and mitigates bridge risks.

However, the Hyper Foundation still holds 60.5% of the total validator stake. While below the 66.7% threshold for full control, roughly 20% of the total stake has been redelegated to the same nodes through the Foundation’s own program, maintaining a high degree of concentration.

These vulnerabilities became evident last March, during the JELLY incident, when a trader allegedly manipulated the token’s price through coordinated on-chain activity, leading to $13.5 million in unrealised losses for the Hyperliquidity Provider (HLP) vault.

Hyperliquid temporarily halted trading and manually settled positions at $0.0095, sparking community backlash. To restore confidence, the Hyperliquid Foundation refunded affected users at $0.037555, excluding flagged addresses.

The team has since pledged to reduce Foundation dominance through progressive delegation and onboarding of new independent validators.

Delegate the growth to third-parties

Another idea from the team to limit its own dominance is to let third-parties build on top of its infrastructure:- With builder codes, developers can create their own front-end on top of Hyperliquid and earn fees. This increases the platform’s distribution and user base. For instance, wallets such as Phantom, Rabby, and MetaMask have integrated Hyperliquid perp markets directly into their interfaces through builder codes. For instance, according to flowscan.xyz, as of 18 November 2025, Phantom has made over $10 million since the launch of this feature on the 8th July 2025. - With HIP-3, entities that stake 500,000 HYPE are allowed to launch and plug their own perp markets into Hyperliquid and benefit from its liquidity. These entities receive 50% of the revenue generated by their markets. As of 18 November 2025, HIP-3 markets have recorded over $100 million in volume.

As Hyperliquid continues to scale, its challenge will be to remain a platform of choice for the capital markets while competition rises — Lighter, Pacifica, EdgeX, and Extended, not to mention the rivalry from “traditional” CEXs that are wary of losing ground. On top of that, it remains to be seen whether Hyperliquid will stay bulletproof from a compliance standpoint, but if it does, it may be well-positioned to compete for institutional interest.