Neue Wege für Bitcoin-Liquidity

3 Min. Lesezeit

- Finanzen

- Bitcoin

- Daten

Seit der Auflegung von Bitcoin fand der Handel hauptsächlich entweder über Over-the-Counter(OTC)-Transaktionen oder über Krypto-Börsen statt. Seit der Einführung von Bitcoin-ETPs (Exchange-Traded Products) im Jahr 2014 haben diese Produkte jedoch nach und nach die Dominanz der Exchanges und des OTC-Handels verringert. Und in jüngster Zeit hat sich dieser Trend deutlich beschleunigt.

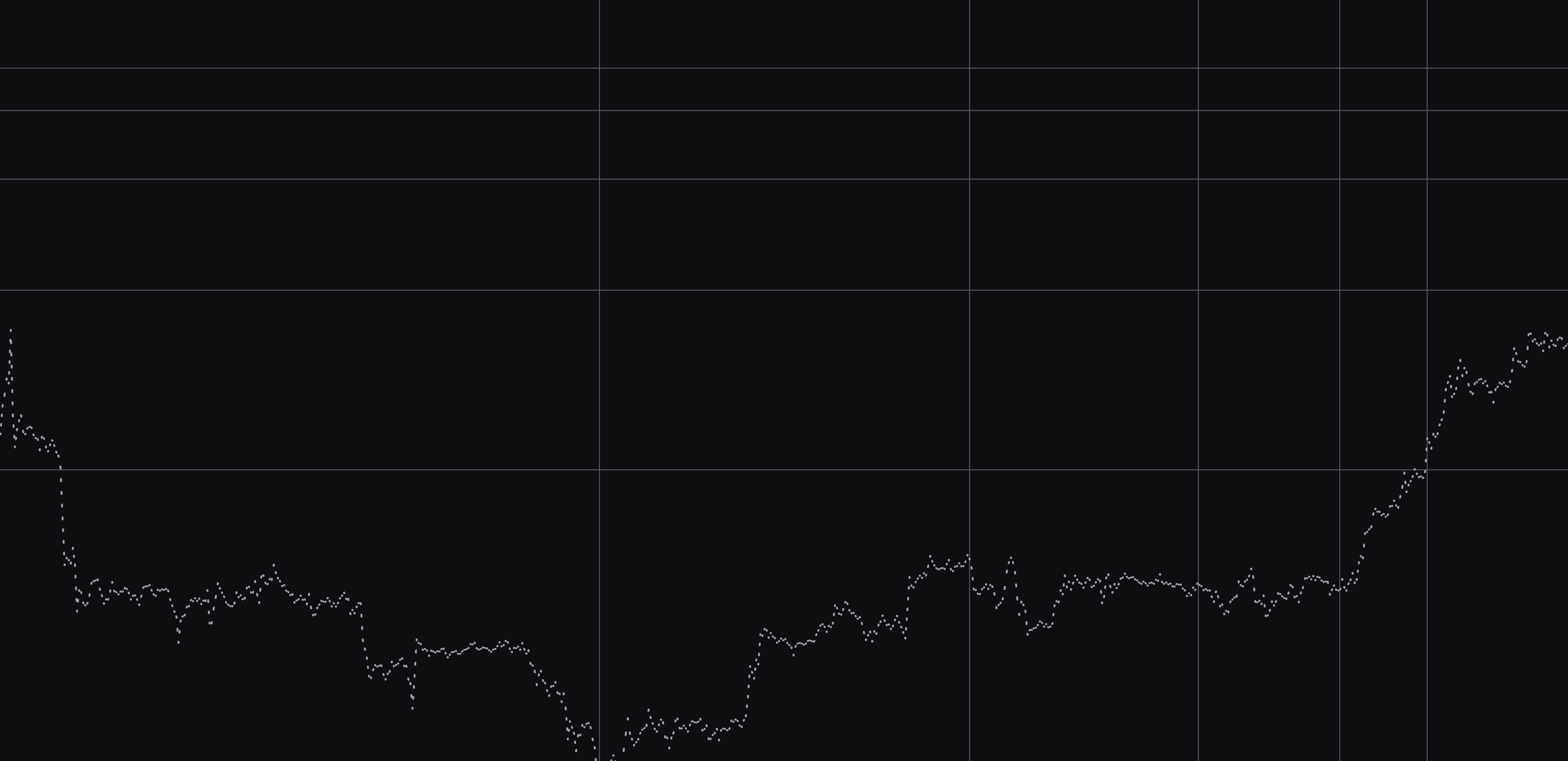

Ein Blick auf die Trends beim Besitz im vergangenen Jahrzehnt zeigt, dass die Zahl der Anleger, die Bitcoin 155 Tage oder länger halten, heute auf dem höchsten Stand seit 2015 liegt. Die Gründe für das Halten von Bitcoin mögen damals noch andere gewesen sein als heute. Trotzdem deutet der übergeordnete Trend darauf hin, dass Anleger zunehmend eine langfristige Bestandsstrategie verfolgen und Bitcoin eher als Wertspeicher betrachten. Aktuell halten mehr als 74 % der Anleger ihre Bitcoin länger als 155 Tage.

Im gleichen Zeitraum erreichte der Anteil an Bitcoin, der an Exchanges gehalten wird, im Juni 2022 18 % des Gesamtangebots (3,45 Millionen BTC, mit einem Wert von 383 Milliarden USD). Seitdem ist dieser Anteil auf nur noch 14 % gesunken, was einer Reduktion von 16,6 % entspricht und etwa 65 Mrd. USD aus den Exchange-Beständen entfernt. In ähnlicher Weise ist das Volumen von Bitcoin, das in OTC-Desk-Wallets gehalten wird, nahezu auf null gefallen.

Im gleichen Zeitraum erreichte der Anteil an Bitcoin, der an Exchanges gehalten wird, im Juni 2022 18 % des Gesamtangebots (3,45 Millionen BTC, mit einem Wert von 383 Milliarden USD). Seitdem ist dieser Anteil auf nur noch 14 % gesunken, was einer Reduktion von 16,6 % entspricht und etwa 65 Mrd. USD aus den Exchange-Beständen entfernt. In ähnlicher Weise ist das Volumen von Bitcoin, das in OTC-Desk-Wallets gehalten wird, nahezu auf null gefallen.

Auch die Bitcoin-Handelsvolumina sind zurückgegangen. Im vergangenen Monat sind die durchschnittlichen Tagesvolumina an Exchanges auf etwa 6 Mrd. USD gefallen, nachdem sie zu Jahresbeginn noch bei 15 Mrd. USD lagen.

Auch die Bitcoin-Handelsvolumina sind zurückgegangen. Im vergangenen Monat sind die durchschnittlichen Tagesvolumina an Exchanges auf etwa 6 Mrd. USD gefallen, nachdem sie zu Jahresbeginn noch bei 15 Mrd. USD lagen.

Auf den ersten Blick mag dies unlogisch erscheinen, insbesondere da Bitcoin nah an den Allzeithochs gehandelt wird, und möglicherweise besorgniserregend wirken. Wir glauben jedoch, dass dies einen grundlegenden Wandel im Anlegerverhalten widerspiegelt. Es ist auffällig, dass die Gesamtzuflüsse in US-basierte Bitcoin-ETFs seit dem Rückgang der an Exchanges gehaltenen Bestände fast den Abflüssen von 68 Mrd. USD entsprechen, was darauf hindeutet, dass Kapital einfach zu einem anderen Handelsplatz verschoben wurde.

Auf den ersten Blick mag dies unlogisch erscheinen, insbesondere da Bitcoin nah an den Allzeithochs gehandelt wird, und möglicherweise besorgniserregend wirken. Wir glauben jedoch, dass dies einen grundlegenden Wandel im Anlegerverhalten widerspiegelt. Es ist auffällig, dass die Gesamtzuflüsse in US-basierte Bitcoin-ETFs seit dem Rückgang der an Exchanges gehaltenen Bestände fast den Abflüssen von 68 Mrd. USD entsprechen, was darauf hindeutet, dass Kapital einfach zu einem anderen Handelsplatz verschoben wurde.

Dieser Wandel zeigt sich am deutlichsten in den Daten zum Handelsvolumen. Seit der Einführung von US-Spot-Bitcoin-ETFs sind ETPs zu einem zunehmend dominanten Kanal für den Bitcoin-Handel geworden. Über den anfänglichen Aktivitätsschub bei der Einführung hinaus machten ETPs im vergangenen Monat im Durchschnitt 48 % des täglichen Bitcoin-Handelsvolumens aus, was etwa 3 Mrd. USD pro Tag entspricht.

Diese Entwicklung deutet auf eine wesentliche Transformation der Art und Weise hin, wie Bitcoin gehandelt wird, nämlich zugunsten regulierter, zugänglicher und vertrauter Finanzinfrastrukturen, wie Exchange-Traded Funds. Wir sind der Ansicht, dass dieser Wandel das Bitcoin-Netzwerk selbst nicht untergräbt, sondern vielmehr eine Diversifizierung der Handelsmechanismen jenseits zentralisierter Krypto-Börsen widerspiegelt.

Diese Entwicklung deutet auf eine wesentliche Transformation der Art und Weise hin, wie Bitcoin gehandelt wird, nämlich zugunsten regulierter, zugänglicher und vertrauter Finanzinfrastrukturen, wie Exchange-Traded Funds. Wir sind der Ansicht, dass dieser Wandel das Bitcoin-Netzwerk selbst nicht untergräbt, sondern vielmehr eine Diversifizierung der Handelsmechanismen jenseits zentralisierter Krypto-Börsen widerspiegelt.

Parallel dazu beobachten wir auch das Aufkommen neuer Möglichkeiten für Anleger, Engagement in Krypto zu erhalten. So gibt es inzwischen etwa 40 börsennotierte Unternehmen, die als Bitcoin-Treasury-Firmen klassifiziert werden. Das sind Firmen, die mehr als 20 % ihrer Netto-Vermögenswerte in Bitcoin halten. Bemerkenswerterweise haben diese Unternehmen im vergangenen Monat kombinierte tägliche Handelsvolumina von 6,5 Mrd. USD erzielt, womit sie das gesamte tägliche Handelsvolumen des FTSE 100 Index übertreffen.

Die Anlegerinteraktion mit Bitcoin verändert sich gerade grundlegend. Was als basisnaher, dezentraler Markt um Exchanges und OTC-Desks herum aufgebaut worden war, weicht zunehmend eher institutionellen, regulierten und etablierten Finanzvehikeln. Der Aufstieg von Bitcoin-ETPs und -ETFs markiert einen Wendepunkt, und das nicht nur in der Art, wie Bitcoin gehandelt wird, sondern auch darin, wie er wahrgenommen wird. Langfristiges Halten nimmt zu, was auf ein wachsendes Vertrauen in Bitcoin als Wertspeicher statt nur als spekulativen Vermögenswert hinweist. Gleichzeitig deuten der starke Rückgang des an Exchanges gehaltenen Bitcoins und das Entstehen börsennotierter Bitcoin-Treasury-Unternehmen auf eine Dezentralisierung der Zugangspunkte und eine Diversifizierung der Anlagestrategien hin. Von einem Signal der Schwäche sind diese Veränderungen weit entfernt. Vielmehr spiegeln sie Bitcoins wachsende Integration in das breitere Finanzökosystem wider. Das Netzwerk bleibt intakt, aber die Zugangswege entwickeln sich weiter, sodass eine größere Bandbreite von Anlegern erreicht wird.