Solana use cases - why and how should I use Solana?

8 min read

- Altcoins

There’s more to Solana than stablecoins. The protocol’s scalability has allowed it to carve out a strong presence in some of Web3’s most dynamic and promising use cases, from the tokenisation of real-world assets (RWAs) to decentralised physical infrastructure networks (DePINs). Before looking at the impact of these applications, it’s worth asking why Solana’s speed and efficiency matter in the first place.

At the speed of Solana

Most blockchains are designed to be secure and decentralised, but often struggle to scale. Transactions can become slow and costly once usage increases. Solana was built to solve this trade-off, offering high throughput and very low fees.

Why does this matter? Because modern applications, especially in finance and consumer services, demand fast, cheap, and reliable infrastructure. Payments, high-frequency trading, decentralised exchanges, gaming, or even global file-sharing networks cannot thrive on blockchains that only handle a handful of transactions per second.

By delivering tens of thousands of transactions per second in real-world conditions and keeping costs as low as a few cents, Solana is one of the fastest blockchains, which opens the door for Web3 apps that feel as seamless as their Web2 counterparts. This explains why developers and institutions alike are increasingly choosing Solana to build and scale.

Driving decentralised finance (DeFi)

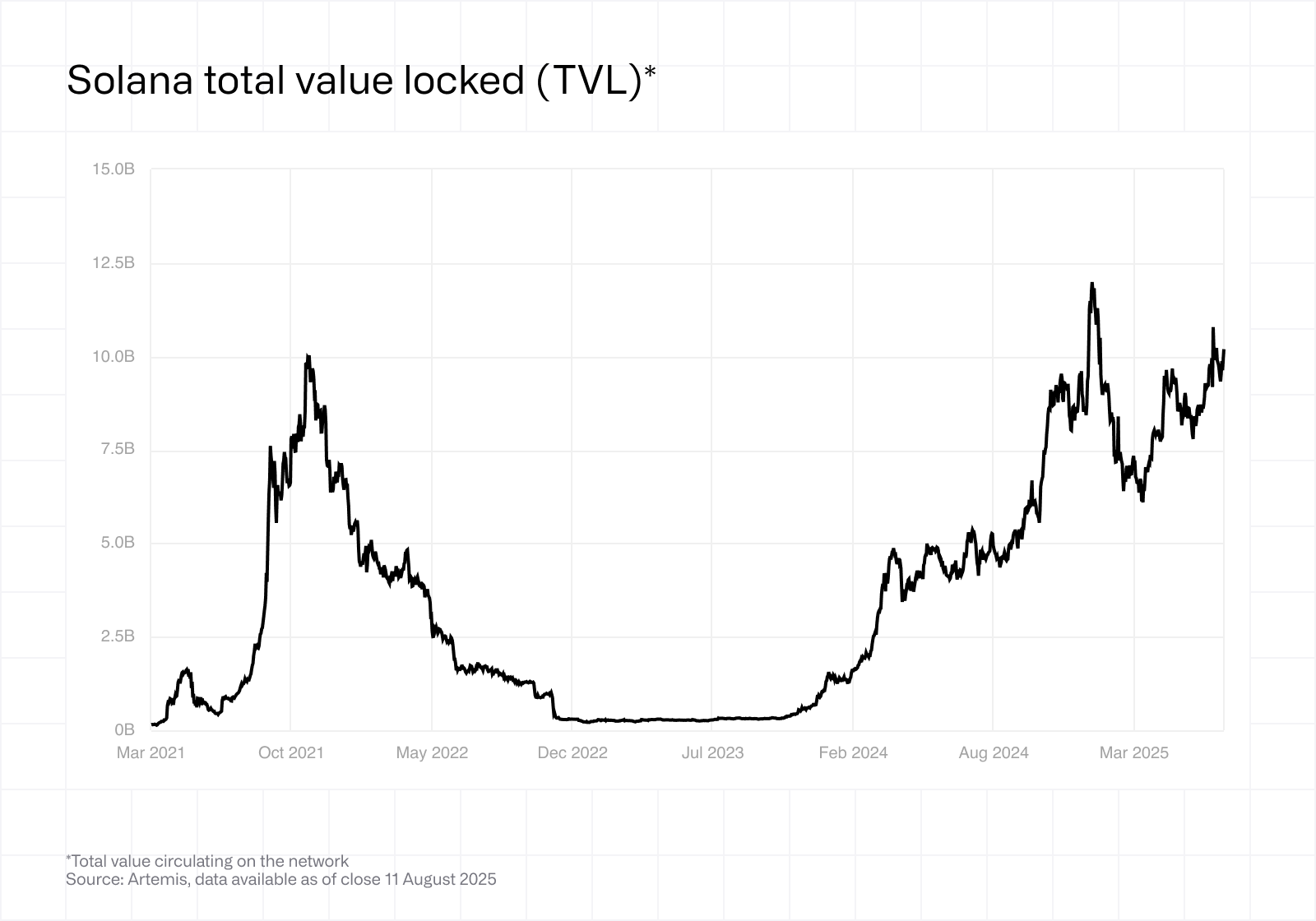

Solana is the second-largest blockchain by total value locked (€10.4B as of September 2025), a metric used to measure the amount of funds deposited on decentralised apps (dApps). Investors monitor TVL because it indicates trust in a protocol as well as liquidity and financial strength.

Two flagship applications dominate:

Two flagship applications dominate:

Jupiter (≈€2.9B TVL), a decentralised exchange for token swaps, trading, lending, and perpetual futures.

Jito Network (≈€3B TVL), a liquid staking platform that distributes staking rewards and issues tokens representing staked SOL for use across DeFi apps.

Beyond DeFi, Solana is becoming a hub for tokenised real-world assets (RWAs), a market projected to reach €1.7T by 2030. Already, €421M of tokenised RWAs sit on Solana, with the figure rising to €9.7B when stablecoins are included.

RWAs are traditional financial instruments or tangible assets issued as blockchain tokens. On Solana, these include:

Tokenised U.S. Treasury bills, giving investors 24/7 access to dollar-denominated yields without going through a bank or broker.

Money market funds, where institutions leverage Solana’s speed and low costs to issue products with real-time settlement.

Stablecoins, which are themselves the largest category of RWAs, with Solana handling billions in USDC and USDT transfers daily.

Why does this matter? RWAs connect traditional finance and blockchain. They offer investors higher accessibility, instant settlement, and potentially lower costs compared to traditional rails. For issuers, Solana’s scalability ensures that millions of transactions, from coupon payments to transfers of ownership, can happen quickly and cheaply.

Institutions experimenting with RWA tokenisation on Solana aren’t just fintech startups but also global banks and asset managers. From Société Générale’s tokenised bonds to BlackRock exploring money market fund issuance, Solana has become a preferred venue because its throughput can handle institutional volumes at scale.

Dominating DePIN

Another use case which is boosting protocol activity, and where Solana is already leading, is DePINs, peer-to-peer platforms that let individuals and companies contribute resources, like computing power, bandwidth, or storage, and earn rewards for doing so. For instance, a user can lend their bandwidth to someone in need of an internet connection and receive rewards in the form of digital tokens.

They’re one of the clearest examples of how Solana’s low fees and high throughput enable real-world adoption at scale.

On Solana, DePIN projects are already making waves:

Render Network: a decentralised GPU-sharing marketplace where creators, game studios, and even Hollywood production houses rent unused computing power for tasks like 3D rendering or AI training. Paramount Games Studio has tapped Render, showing its appeal beyond the crypto-native world.

Helium: a decentralised wireless network where individuals set up low-cost hotspots to provide Wi-Fi and earn rewards in return. It’s already deployed globally, giving Solana real-world visibility in telecom services.

Hivemapper: a crowdsourced mapping service where drivers earn tokens by sharing dashcam footage. Over time, this could rival traditional mapping providers with a decentralised alternative.

Solana is also one of the few networks to have produced its own hardware. The Seeker smartphone is an Android device that offers Web3 features like a vault to safeguard a digital wallet’s private keys (required to enable crypto transactions) and access to Solana’s app store.

‘Developing exclusive devices and app stores for crypto users and charging fees far lower than traditional platforms…can open up new paths in the monopoly of giants,’ Solana founder Anatoly Yakovenko told PA News.

These examples illustrate why Solana’s ability to process thousands of microtransactions cheaply matters. DePINs require constant small payments (rewards for data, bandwidth, or computing contributions). On slower or more expensive blockchains, this model would break down. Solana’s architecture makes it viable, positioning it as the backbone for a new class of internet-scale infrastructure.

The financialisation of SOL

Several ETPs trading on the European markets, with total assets under management of €2.2B (as of September 2025), provide exposure to Solana’s innovation. These products offer easier access to SOL than buying directly on a crypto exchange because they trade on mainstream brokerages, so they can sit in a portfolio alongside traditional assets and contribute to overall returns.

Solana is also experiencing institutional adoption, which has previously been a bullish signal for bitcoin. As of September 2025, companies hold €850M worth of SOL on their balance sheets. Two of the biggest holders are DeFi Development Corp, a real estate technology developer, and data aggregator Upexi. Both of these companies are publicly listed, so their shares can serve as a SOL proxy.

Conclusion

Solana’s speed and low transaction fees have attracted users in a range of promising use cases, including RWA tokenisation and DePINs, establishing it as one of the biggest protocols by TVL. This momentum has helped SOL, the protocol’s native token, near all-time highs as of September 2025 (but past performance doesn’t guarantee future results). While investors can gain exposure by purchasing SOL directly, more accessible routes include ETPs that trade on mainstream exchanges and shares in companies holding SOL in their treasuries.