Crypto without the drawdowns

6 min read

- Finance

- Bitcoin

- Ethereum

CGCI (CoinShares Gold and Cryptoassets Index) has been designed to provide risk-managed exposure to cryptoassets without extreme volatility and downside risk.

Our research shows:

Low correlation with traditional asset classes which can enhance risk-adjusted returns in a wider portfolio.

Risk and return profile that has been superior to holding gold or cryptoassets alone.

Serves as an effective portfolio diversifier - adding 4% of CGCI did not impact on portfolio risk while enhancing annualized returns by 3%.

Cryptoassets for the more risk-averse investor remains a challenging prospect given the high volatility and historically large drawdowns. In the last 3 years, cryptoasset prices have seen a maximum peak to trough fall of 80%, however, we believe they present an opportunity to invest in a non-sovereign store of value which historically has not been correlated to traditional asset classes.

Cryptoassets have some similarities to gold, they typically have a fixed supply and are therefore likely to be scarce relative to fiat. There is also evidence of a link to inflation and some evolving into a store-of-value. The key difference between these two is that gold is a physical asset while cryptoassets are a digital asset derived from the growth in networks and the proliferation of the world wide web. Could gold and cryptoassets combined combine the merits of a safe-haven with diversification?

The CGCI (CoinShares Gold and Cryptoassets Index) was designed, in conjunction with Imperial College, with the aim of providing diversified exposure to alternative assets in a way that yields a superior risk-return profile when compared to holding such assets in isolation, while being de-correlated to traditional financial markets.

The CGCI utilises the concept of volatility harvesting, where two ideally uncorrelated assets, at least one of which is highly volatile, are periodically rebalanced. The resulting expected growth rate is typically greater than the average of the expected individual growth rates while the variance in returns is less than average of the individual variances. Put in simple terms, higher growth and lower volatility may be achieved when the two assets are combined.

Methodology

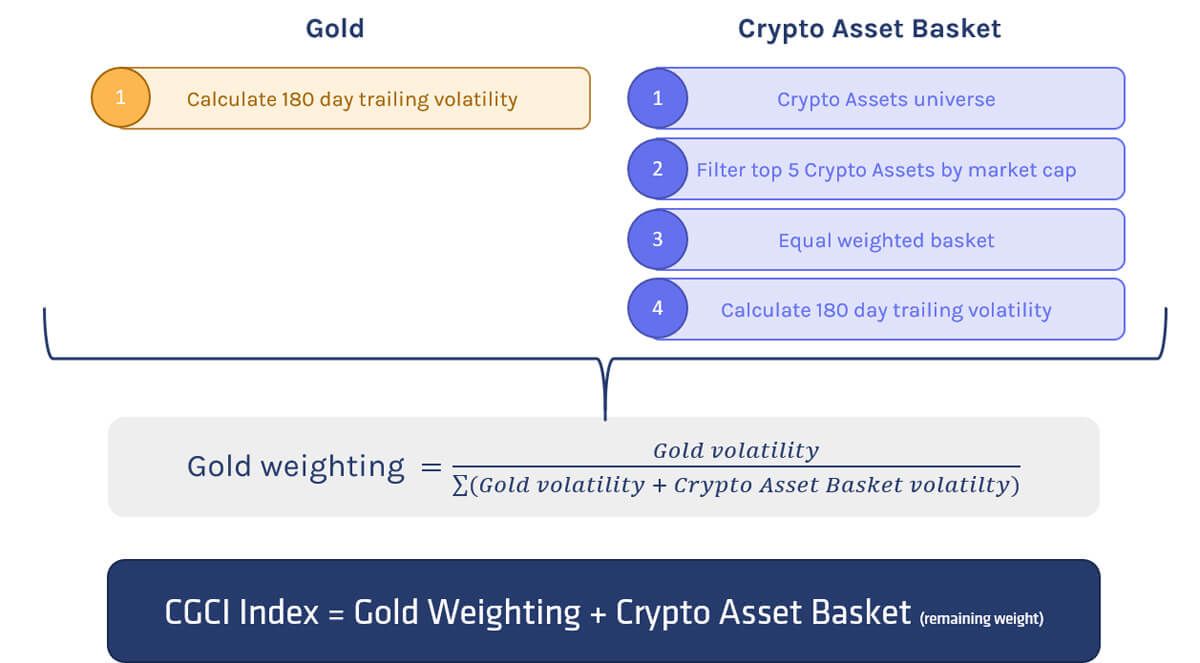

The CGCI is composed of a fixed number of constituents including five cryptoassets and physical gold. The cryptoasset constituents are the top five eligible cryptoassets based on the 6-month rolling average market capitalisation with the selection and rebalancing of the constituents occurring on a monthly basis. By restricting CGCI to the top five cryptoassets we are less likely to encounter liquidity issues.

To ensure stability and reputability of the index while remaining faithful to the cryptoasset concept each constituent must have at least a 6-month trading history on a reputable exchange and has been on its native blockchain for at least 6-months. Furthermore, it must trade in USD, not be linked to a fiat currency or be a privacy-focussed coin such as Monero or ZCash. We also check the cryptoasset has not suffered a major chain reorganisation in the last 6 months and is not subject to a forthcoming contentious hard fork before the next selection is due to take place.

The weights between the cryptoassets is equal weighted, while between gold it is determined by the weighted-risk allocation scheme detailed below.

Once the top five cryptoassets are defined, the 180-day trailing volatility of the equal weight crypto-basket is calculated. The weighting between gold and the crypto-basket is then calculated by dividing the 180-day gold volatility by the crypto-basket volatility.

Historically, this has led to cryptoassets comprising between 40% and 10% of the index.

Performance

When comparing the CGCI (since mid-2017) to Bitcoin or other multi-crypto indices it highlights almost double the returns to simply investing in gold alone. Crucially, CGCI reduces volatility to one quarter of Bitcoin volatility and other multi-crypto indices leaving the Sharpe ratio at 1.14, well above both gold and Bitcoin. One challenge as a portfolio manager investing in Bitcoin is the risk of being stopped-out (the execution of a stop-loss order), given Bitcoin’s annualised volatility of 78% the chances of this happening are much higher compared to traditional investments and consequently many investors reject Bitcoin as an investment.

CGCI mitigates the risk of being stopped-out due to its much lower volatility, this can also be seen in its maximum-drawdown (the peak-trough decline), which is considerably lower at 26% decline relative to Bitcoin’s 83% and World equities at 34%.

CGCI in a portfolio

To test how CGCI would help or hinder a portfolio we created a database of daily returns starting from 2017, when there was sufficient data for all comparable indices. We created a traditional balanced portfolio with 60% equities and 40% bonds and then added a notional 4% CGCI, detracting from both equities and bonds equally. Our analysis, as indicated in the table below, highlights that CGCI has enhanced annualised returns by 1.1% relative to the 60/40 portfolio benchmark. The Sharpe ratio (volatility adjusted returns) is 0.76 while the correlation falls by 0.5%.

As expected, there is negligible impact on drawdowns in the portfolio, particularly in comparison to its peers, such as the Bitwise 10 Large Cap Crypto Index. This highlights that a diversified crypto investment (across multiple cryptoassets) has not protected investors from high drawdowns due to their highly correlated nature.

By adding CGCI to a portfolio in incremental steps we can gauge how much impact it has on volatility of the overall portfolio. We find that it reduces risk in small weightings while significantly enhancing returns.

This is not the case for cryptoassets on their own, which tend to increase overall portfolio volatility as more is added. Applying the same incremental approach but looking at the Sharpe ratio highlights that on a risk-adjusted basis pure cryptoasset investments have provided better performance over this time period.

We also find similar results for correlation.

We also find similar results for correlation.

It is important to note that while these charts suggest the CGCI index is not better on a risk-adjusted basis, or that it doesn’t diversify as well, it isn't considering maximum drawdowns. This is an important factor for investors as most will be stopped-out if their investment falls by 80%, CGCI is therefore not comparable to pure cryptoasset investments.

Sensitivity analysis

Understanding the sensitivities of CGCI is essential to gauge how it may perform in various economic scenarios. As we would expect it does have a high correlation to gold due to the high proportion of gold in the index, consequently it exhibits an inverse relationship with the US dollar.

The CGCI looks to have an inverse relationship with treasury prices although the results are mixed, with it being positively correlated since inception but more recently having an inverse relationship. Other analysis work on Bitcoin has highlighted a strong inverse relationship with 10-2yr treasury yield convexity. We expect this relationship to be the same for CGCI, acting as a safe-haven asset during periods of economic weakness.

Summary

CGCI has all the merits of a safe haven alternative asset, reducing risk in a portfolio (in small allocations) while enhancing returns. Although it does not diversify as well as pure cryptoassets it is better than safe havens such as gold. CGCI might just be the answer for investors who are keen to invest into the cryptoasset class but are fearful of the stop-losses that cryptoassets often trigger.