Why diversify with crypto?

8 min read

- Finance

Introduction to crypto

Crypto in the real world

Crypto investment options

Strategies and practical tips

Traditional portfolios are less diversified than they appear. Stocks and bonds, once reliable counterweights, increasingly move in tandem—meaning the classic 60/40 split delivers less risk reduction than investors expect. This has prompted a search for assets that behave independently. Cryptocurrency, driven by distinct factors from traditional markets, has emerged as a serious candidate for potentially improving risk-adjusted returns.

This article examines why adding a modest crypto allocation can improve portfolio performance, what the data shows about optimal allocation levels, and how European investors can access this asset class through regulated products.

A brief history of crypto

“Crypto” refers to digital currencies that rely on cryptography to secure transactions. The first Bitcoin (BTC) was mined, i.e created, in 2009, followed in 2015 by Ethereum (ETH). Bitcoin and Ethereum adoption has grown steadily ever since, as illustrated by the charts below.

They show the number of BTC & ETH unique addresses. Also known as wallets, they enable users to make transactions with or store BTC/ETH. As of December 2025, there are over 1,4 billion BTC addresses, and over 250 million ETH addresses, and amongst them, over 50 million BTC addresses and 161 million ETH addresses with a non-zero balance.

Today, there are thousands of cryptocurrencies available on the market. Most investors focus on BTC and ETH, which are considered to be major players in the crypto ecosystem, and are referred to as “blue-chip” coins. BTC in particular is the most popular crypto, with a market capitalization of $2 trillion as of December 2025, and it is often the first crypto asset traders invest in.

Today, there are thousands of cryptocurrencies available on the market. Most investors focus on BTC and ETH, which are considered to be major players in the crypto ecosystem, and are referred to as “blue-chip” coins. BTC in particular is the most popular crypto, with a market capitalization of $2 trillion as of December 2025, and it is often the first crypto asset traders invest in.

Bitcoin is a decorrelated asset that can help you diversify your portfolio

Diversification is a way to limit risk by investing in assets that are not fully correlated. Correlation is a statistical measure that tracks how two assets move in relation to each other. Let’s say a trader invests in two assets: A and B. If A and B’s correlation is 100%, it means they are perfectly correlated: their value rises and falls at exactly the same pace. As a result, the investor’s portfolio is not diversified at all: any adverse event affecting A is reflected in B’s value. On the contrary, if A and B’s correlation is -100%, the assets are negatively correlated, and move in opposite directions.

Investors aiming to effectively reduce their risk are looking for assets with as low correlation as possible. This means assets are moving independently from each other, and makes for a diversified portfolio.

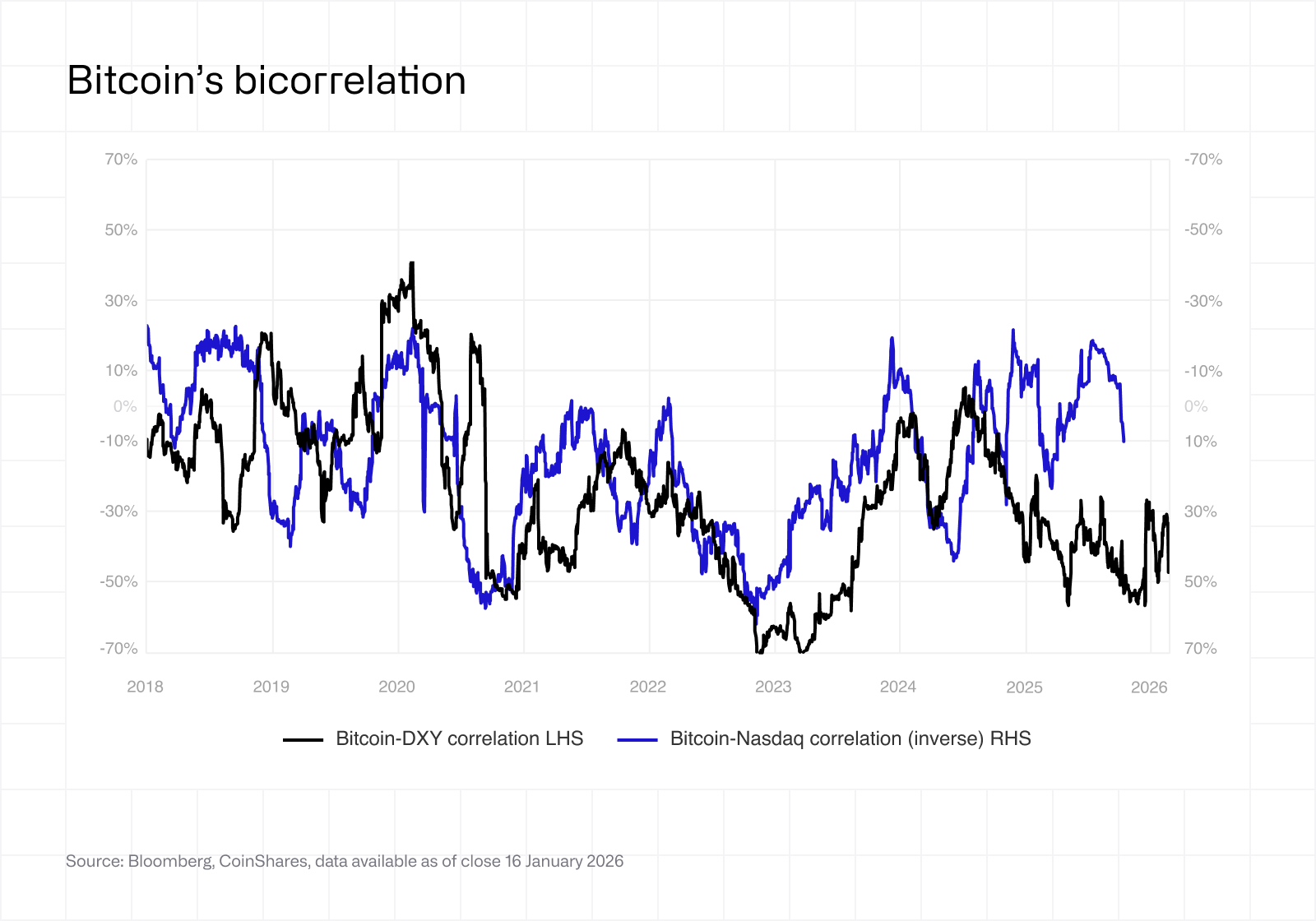

Bitcoin’s correlation to other assets has historically been quite low, as reflected in the chart below.

The Nasdaq 100, an index tracking the stock performance of 100 of the largest non-financial companies in the Nasdaq Composite, is often used as a benchmark. The Bitcoin–Nasdaq relationship has oscillated between negative and positive phases, strengthening during risk-on cycles (2020–2022) and weakening as macro conditions changed (2023–2025). This suggests Bitcoin’s dual identity as both a risk asset and a diversifier depending on the macro environment.

However, Bitcoin’s correlation to traditional assets tends to increase as the asset matures. In addition, Bitcoin can also react to major macroeconomic events, such as interest rate hikes.

Why is portfolio diversification important?

Diversification works by combining assets that don't move in lockstep. When one asset declines, another may hold steady or rise, smoothing overall portfolio returns. The statistical measure for this relationship is correlation: a value of 100% means assets move identically; lower correlations indicate more independent behaviour.

The challenge facing modern investors is that traditional diversification has weakened. Stocks and bonds, historically reliable counterweights, increasingly move together during periods of market stress. This convergence has driven sophisticated investors toward alternative assets—including digital currencies—that can provide genuine portfolio diversification.

How does crypto improve portfolio performance?

CoinShares' proprietary modelling, based on data from January 2020 to December 2025, demonstrates that a 5% allocation to crypto can meaningfully enhance portfolio metrics without materially increasing volatility.

The results are striking. Adding just 5% crypto to a traditional portfolio has historically as historically nearly doubled the Sharpe ratio—a key measure of risk-adjusted returns—while volatility remains virtually unchanged. Annualised returns improve from 4.8% to between 8.2% and 9.4%, depending on the crypto strategy employed.

What is the optimal crypto allocation?

Based on CoinShares' analysis, a 5% allocation represents a potential balance between enhanced returns and controlled risk. At this level, the portfolio captures meaningful upside from crypto's growth potential while limiting the impact of its inherent volatility on overall portfolio stability.

The data shows that maximum drawdown increases only modestly—from -24.1% to approximately -26%—an acceptable trade-off for the significant improvement in risk-adjusted performance. Meanwhile, correlation with the traditional portfolio drops to around 95%, confirming that crypto provides genuine diversification benefit.

For conservative investors, the 5% Bitcoin-only allocation offers the most straightforward approach, improving the Sharpe ratio from 0.39 to 0.67. Those comfortable with broader crypto exposure may consider a diversified basket—either a BTC/ETH mix or a Top 50 index strategy—which delivers even stronger risk-adjusted returns.

Why consider altcoins alongside Bitcoin?

While Bitcoin remains the foundation of most crypto allocations, the data suggests that diversifying within the crypto allocation itself can further improve outcomes. The Top 50 Index strategy—spreading the 5% allocation across leading cryptocurrencies by market capitalisation—historically delivered the highest Sharpe ratio (0.75) and annualised return (9.4%) over the period studied.

Each major cryptocurrency serves a distinct purpose within the digital asset ecosystem:

Bitcoin (BTC) functions primarily as a store of value—often described as 'digital gold'—and remains the most liquid and institutionally adopted digital asset.

Ethereum (ETH) powers the programmable layer of decentralised finance, with its smart contract functionality underpinning thousands of applications.

Solana (SOL) focuses on speed and scalability, processing thousands of transactions per second—positioning it for payments and high-frequency applications.

Investors should note that altcoins carry higher volatility than Bitcoin and require ongoing monitoring. For those seeking simplicity, a Bitcoin-only allocation remains a sound approach.

Why is rebalancing essential?

Given crypto's volatility, regular rebalancing is critical to maintaining your intended risk profile. If a 5% crypto allocation doubles in value while other assets remain flat, crypto could suddenly represent 9–10% of your portfolio—exposing you to more volatility than originally intended.

Rebalancing enforces discipline by systematically selling positions that have grown beyond their target weight and reinvesting in underweight assets. This 'sell high, buy low' mechanism operates without relying on emotional decision-making.

Most investors review their portfolios quarterly or annually. Some prefer threshold-based rebalancing—adjusting only when an asset deviates by more than a set percentage from its target weight. The specific approach matters less than consistency: choose a method and maintain it.

What is the easiest way to add crypto to a portfolio?

For European investors seeking regulated, straightforward access to crypto, Exchange-Traded Products (ETPs) offer a compelling solution. Crypto ETPs trade on regulated securities exchanges across Europe and can be purchased through existing bank or broker relationships—just like any other security.

The advantages are significant: no need to manage private keys or custody solutions, no exposure to unregulated exchanges, and seamless integration with existing portfolios for analysis and rebalancing. Europe now hosts over 200 crypto ETPs representing more than €12 billion in assets under management.

Key takeaways

Traditional 60/40 portfolio diversification has weakened as stocks and bonds increasingly move together

A 5% crypto allocation nearly doubles the Sharpe ratio while keeping volatility virtually unchanged

Annualised returns improved from 4.8% to 8.2–9.4% with a 5% crypto allocation (2020–2025 data)

Diversifying within the crypto allocation (e.g., Top 50 Index) can further improve risk-adjusted returns

Regular rebalancing is essential to maintain your intended risk profile

Crypto ETPs provide regulated, convenient access without the complexity of direct ownership

Introduction to crypto

Crypto in the real world

Crypto investment options

Strategies and practical tips