Digital asset fund flows | February 2nd, 2026

2 minuti di lettura

- Dati

Investor sentiment deteriorates as outflows accelerate

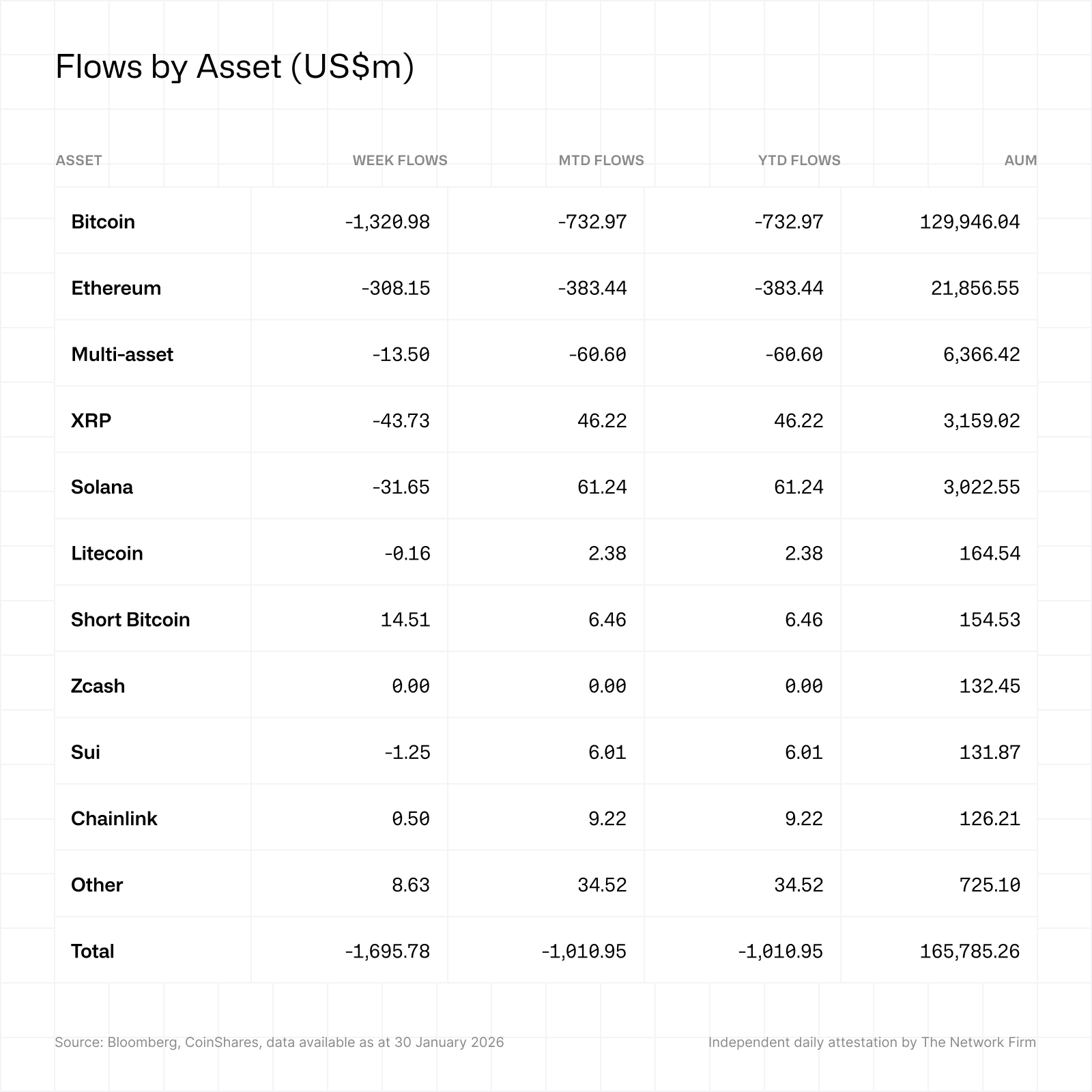

Digital asset products saw US$1.7bn of weekly outflows, flipping YTD flows to a net outflow of US$1bn and driving a US$73bn fall in AuM since October 2025 highs.

Outflows were heavily concentrated in the US at US$1.65bn, with broadly negative sentiment across regions and major assets, led by Bitcoin and Ethereum.

Short Bitcoin and Hype products were notable exceptions, benefiting from defensive positioning and tokenised precious metals activity respectively.

Digital asset investment products recorded a second consecutive week of outflows, totalling US$1.7bn. This has reversed year-to-date inflows, leaving net YTD flows at a global outflow of US$1bn, signalling a marked deterioration in investor sentiment towards the asset class. We believe this reflects a combination of factors, including the appointment of a more hawkish US Federal Reserve Chair, continued whale selling associated with the four-year cycle, and heightened geopolitical volatility. Since the price highs in October 2025, we have seen total assets under management (AuM) fall by US$73bn.

Regionally, the US saw US$1.65bn in outflows, with similar negative sentiment in Canada and Sweden which also saw outflows of US$37.3m and US$18.9m respectively. Very minor inflows were seen in Switzerland (US$11.0m) and Germany (US$4.3m).

Regionally, the US saw US$1.65bn in outflows, with similar negative sentiment in Canada and Sweden which also saw outflows of US$37.3m and US$18.9m respectively. Very minor inflows were seen in Switzerland (US$11.0m) and Germany (US$4.3m).

Across the assets negative sentiment was broad, with Bitcoin seeing US$1.32bn in outflows, Ethereum saw US$308m, while recent favourites XRP and Solana also saw outflows of US$43.7m and US$31.7m respectively. Short bitcoin saw inflows totalling US$14.5m, with a YTD rise in AuM of 8.1%.

Across the assets negative sentiment was broad, with Bitcoin seeing US$1.32bn in outflows, Ethereum saw US$308m, while recent favourites XRP and Solana also saw outflows of US$43.7m and US$31.7m respectively. Short bitcoin saw inflows totalling US$14.5m, with a YTD rise in AuM of 8.1%.

Hype investment products, were a bright spot, seeing US$15.5m inflows, benefitting from recent on-chain sales frenzy in tokenised precious metals.