Digital asset fund flows | December 15th, 2025

3 min read

- Data

Digital Asset Funds See Continued Inflows as Investor Confidence Gradually Improves

Digital asset ETPs saw US$716M in weekly inflows, lifting total AuM to US$180B, though still well below the US$264B all-time high.

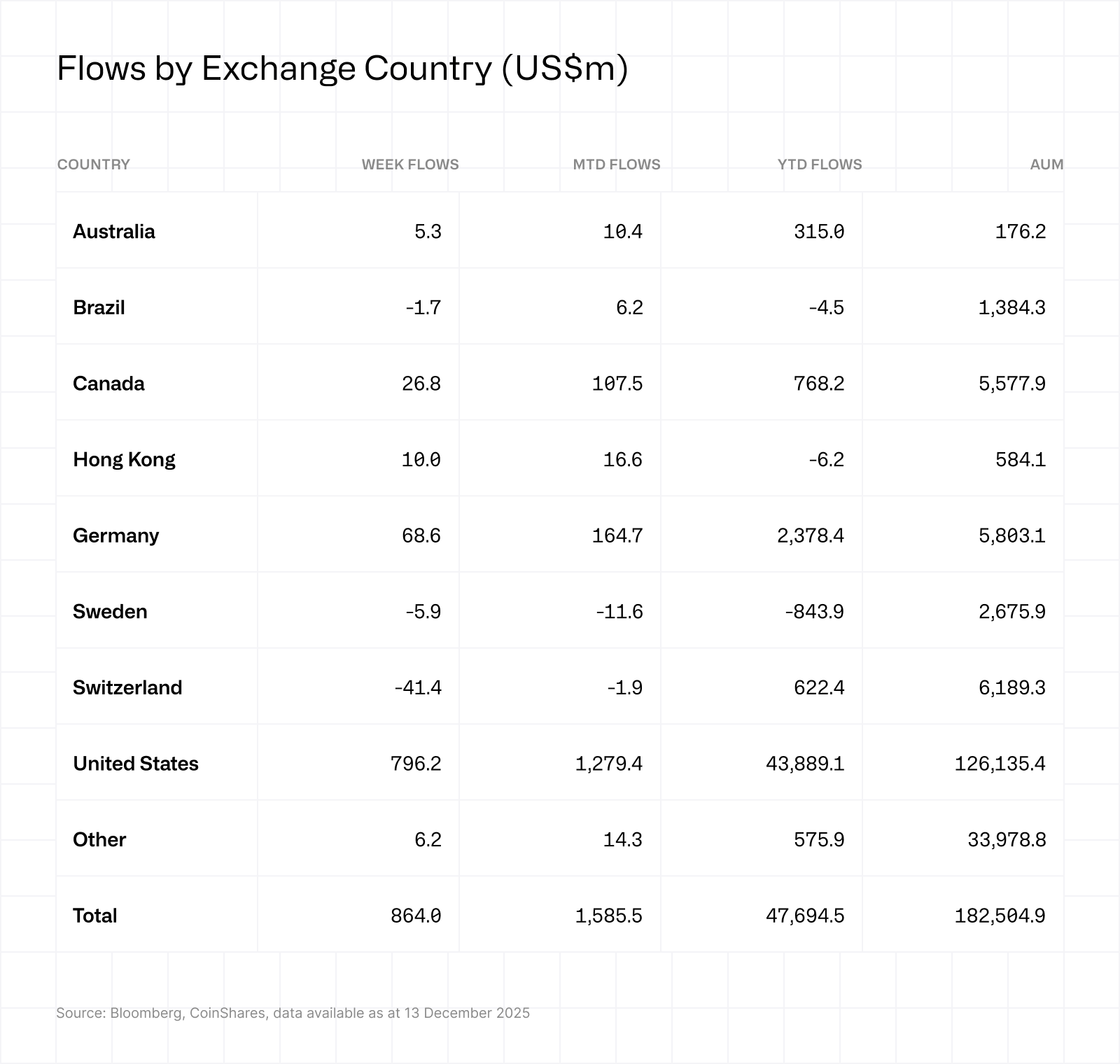

Inflows were broad-based, led by the US (US$483M), Germany (US$96.9M) and Canada (US$80.7M).

Bitcoin attracted US$352M while XRP (US$245M) and Chainlink (US$52.8M, a record inflow representing 54% of AuM) also saw strong demand; short-Bitcoin products recorded significant outflows, hinting at easing negative sentiment.

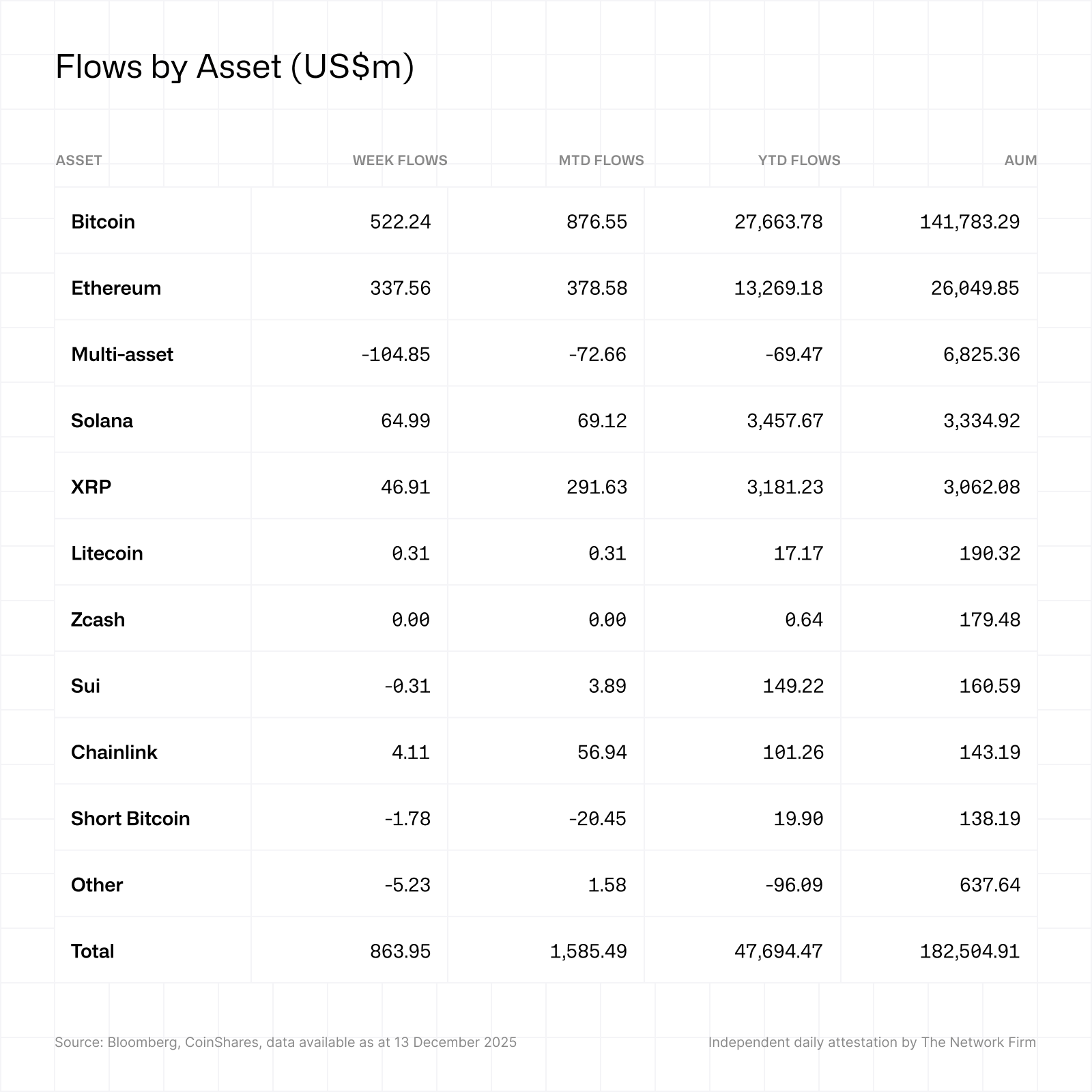

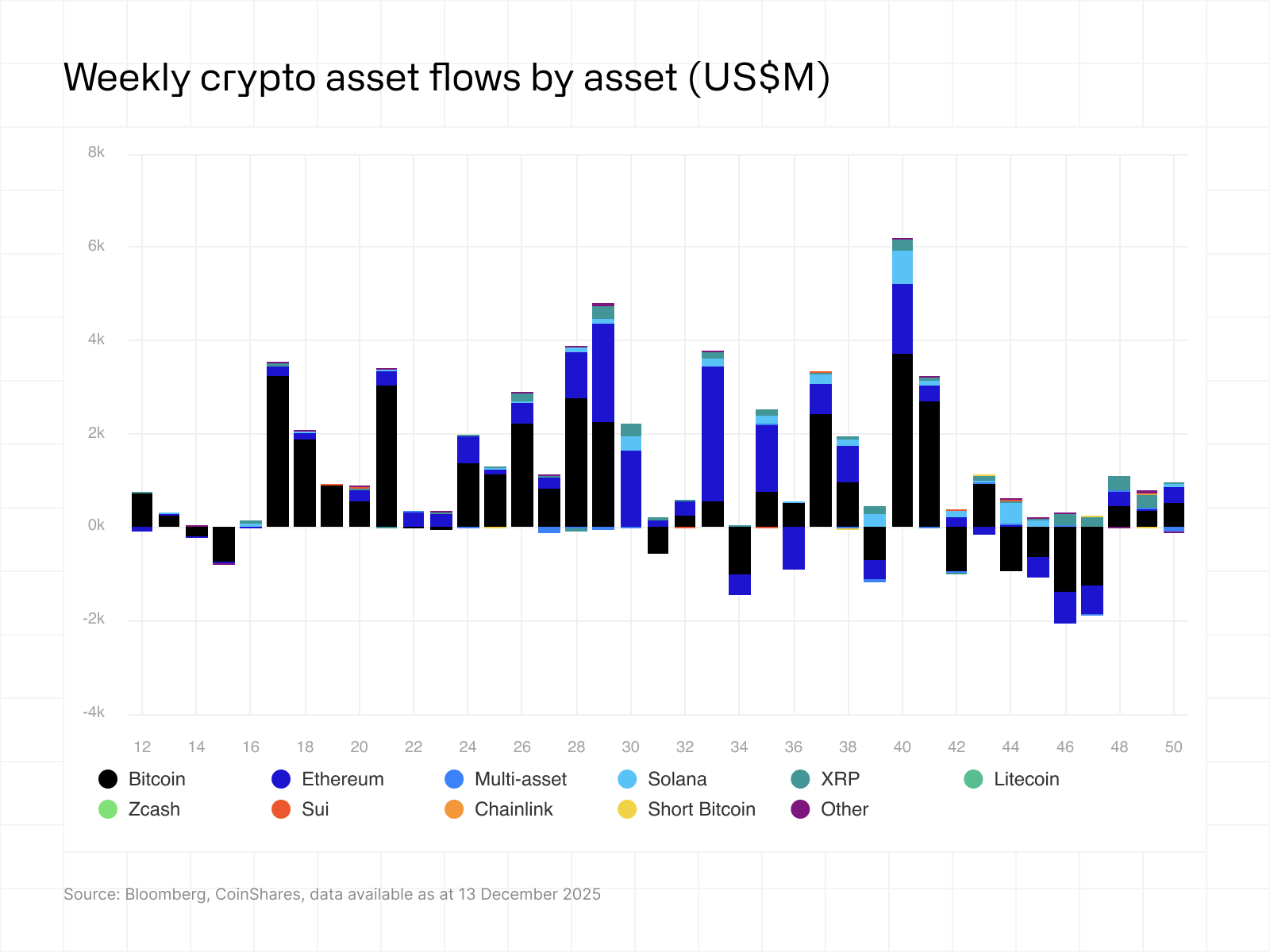

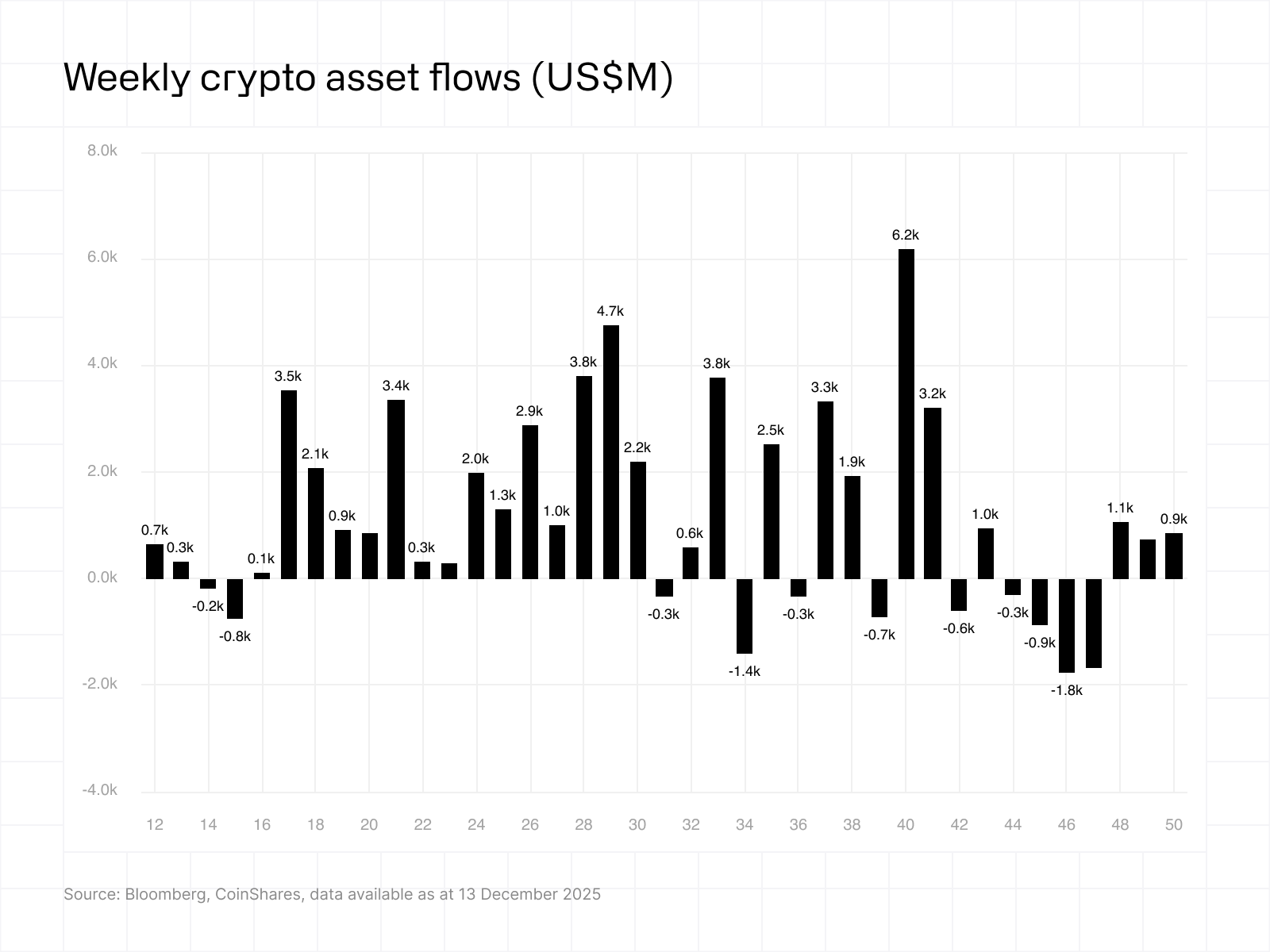

Digital asset investment products saw inflows totalling US$864m. This marks the third week of modest inflows overall, which we believe reflects a cautious yet increasingly optimistic investor base. Despite the recent interest rate cut by the US Federal Reserve, price performance has been subdued, with trading days following the cut showing mixed sentiment and uneven flows.

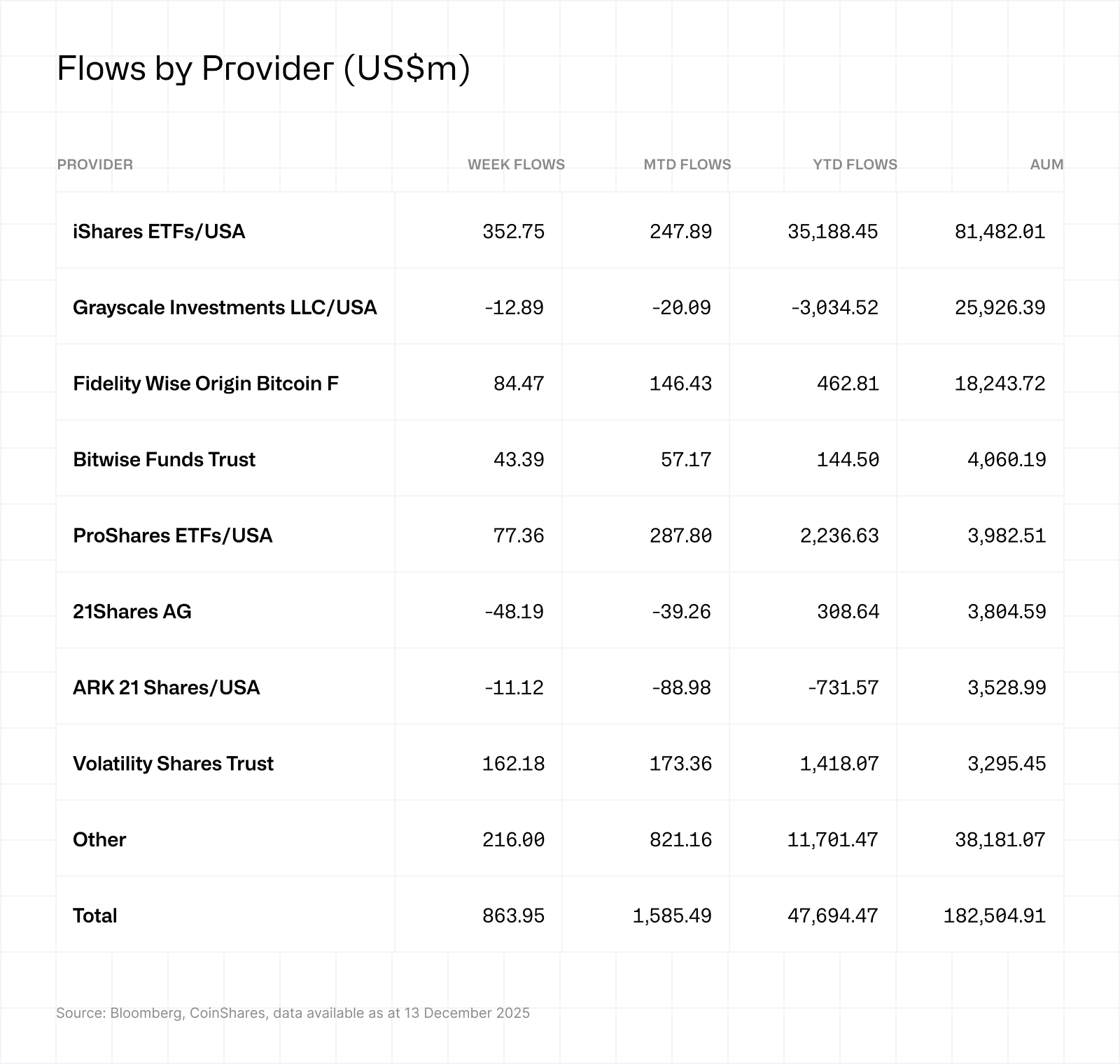

Regionally, the strongest sentiment was observed in the US, which saw US$796M of inflows last week. Inflows were also recorded in Germany (US$68.6M) and Canada (US$26.8M). These three countries have dominated flows this year, accounting for 98.6% of year-to-date (YTD) inflows.

Bitcoin attracted US$522m of inflows, while short Bitcoin investment products continued to see outflows totalling US$1.8M, signalling a recovery in sentiment. Despite this, Bitcoin remains a relative laggard this year, with YTD inflows of US$27.7B compared to US$41B in 2024.

Ethereum recorded inflows of US$338M last week, bringing YTD inflows to US$13.3B, an increase of 148% compared to 2024. Solana inflows remain lower at US$3.5B YTD, but this still represents a tenfold increase relative to 2024. Aave and Chainlink saw inflows of US$5.9M and US$4.1M respectively last week, while Hyperliquid saw outflows of US$14.1M.