Digital asset fund flows | August 25th 2025

2 min read

- Data

The materials on this website or any third-party websites accessed herein are not associated with and have not been reviewed or approved by: (i) Valkyrie Funds LLC dba CoinShares, its products, or the distributor of its products, or (ii) CoinShares Co., its products, or the marketing agent of its products.

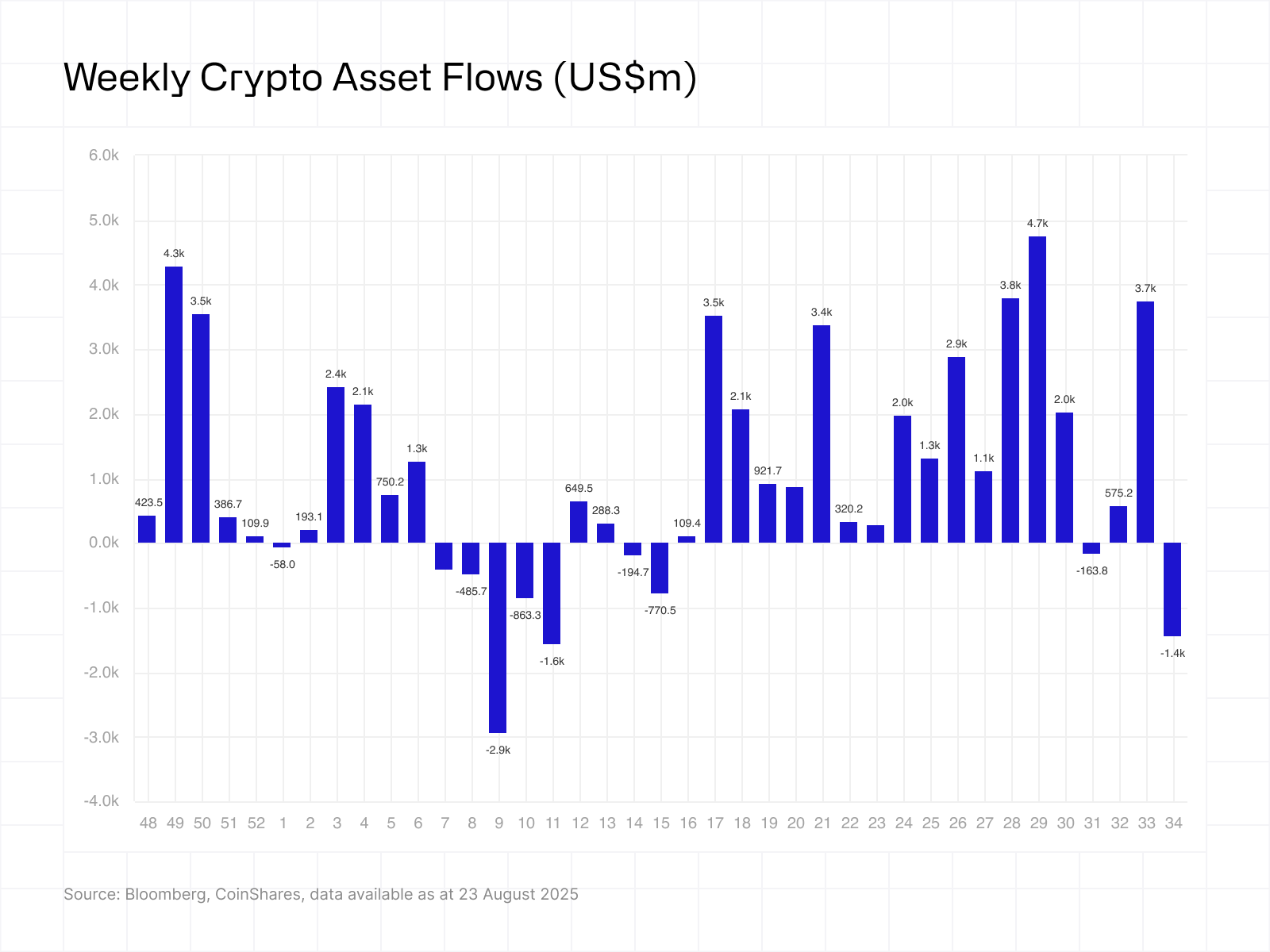

Fears over FED action prompt largest outflows since March of US$1.43bn

Digital asset investment products saw US$1.43bn in outflows, the largest since March, with ETP trading volumes surging to US$38bn.

Bitcoin recorded US$1bn in outflows, while Ethereum showed resilience with only US$440m out, driving month-to-date inflows of US$2.5bn versus Bitcoin’s US$1bn net outflows.

Altcoin flows were mixed: XRP (+US$25m), Solana (+US$12m), and Cronos (+US$4.4m) gained, while Sui (-US$12.9m) and Ton (-US$1.5m) suffered losses.

Digital asset investment products recorded their first significant outflows in weeks, totalling US$1.43bn, the largest since March. Trading volumes in ETPs reached US$38bn last week, about 50% above this year’s average, as investor sentiment became increasingly polarised over US monetary policy. Early in the week, pessimism around the Federal Reserve’s stance drove outflows of US$2bn. However, sentiment shifted later in the week following Jerome Powell’s address at the Jackson Hole Symposium, which was widely interpreted as more dovish than expected, sparking inflows of US$594m.

This shift in tone was more strongly reflected in Ethereum than in Bitcoin. Ethereum saw a sharp mid-week recovery, limiting outflows to US$440m compared to Bitcoin’s US$1bn. Month-to-date figures now show inflows of US$2.5bn into Ethereum, while Bitcoin has experienced net outflows of US$1bn, marking a notable change in investor sentiment toward the two assets. Inflows year-to-date for Ethereum represent 26% of total assets under management compared to just 11% for Bitcoin.

A wide selection of altcoins saw inflows, most notable being XRP (US$25m), Solana (US$12m) and Cronos (US$4.4m). While Sui and Ton suffered the most with outflows of US$12.9m and US$1.5m respectively.