Bitcoin mining explained – process, benefits, and challenges

18 min read

- Bitcoin

- Mining

- Environment

Introduction to crypto

Crypto in the real world

Crypto investment options

Strategies and practical tips

Bitcoin mining is the backbone of the Bitcoin network. It's how new bitcoins are created and how the network stays secure, decentralised, and functional—without the need for central authorities like banks or payment processors.

What Is Bitcoin mining?

At its core, mining is the process by which new bitcoins enter circulation and by which transactions are confirmed and added to Bitcoin's public ledger: the blockchain. Miners use powerful computers to solve complex mathematical puzzles. The first to solve each puzzle validates a new block of transactions and is rewarded with newly issued bitcoin, plus transaction fees from users.

This system ensures that only valid transactions are added to the blockchain, and it happens without any central oversight. This consensus mechanism is called “Proof of Work”: only miners providing computational resources can earn rewards.

What is Proof of Work and how does it relate to Bitcoin mining?

Proof of Work (PoW) is the consensus mechanism that supports Bitcoin mining. By turning electricity into computation, miners make it expensive to alter the blockchain. As mining is decentralized, no single miner has control, instead, security is provided by the collective work of thousands of participants worldwide.

The more mining power is distributed, the harder it becomes for anyone to manipulate the record of transactions.

PoW secures the Bitcoin protocol by linking the protocol's integrity to real-world cost. Any attempt to rewrite transactions or double-spend would require surpassing the combined hash power of honest miners, an undertaking so resource-intensive that it becomes economically self-defeating.

In this way, PoW turns energy expenditure and computational effort into a barrier that protects the public ledger from tampering, a mechanism best understood by looking at the mining process step by step. Therefore, this computing power is not a waste of resources; on the contrary, it is a feature of the Bitcoin network, as it is what makes Bitcoin resilient. Bitcoin is secured by miners: the more miners there are, the more secure the blockchain becomes. Since the protocol automatically increases mining difficulty as more miners participate, the energy required to breach this security also rises.

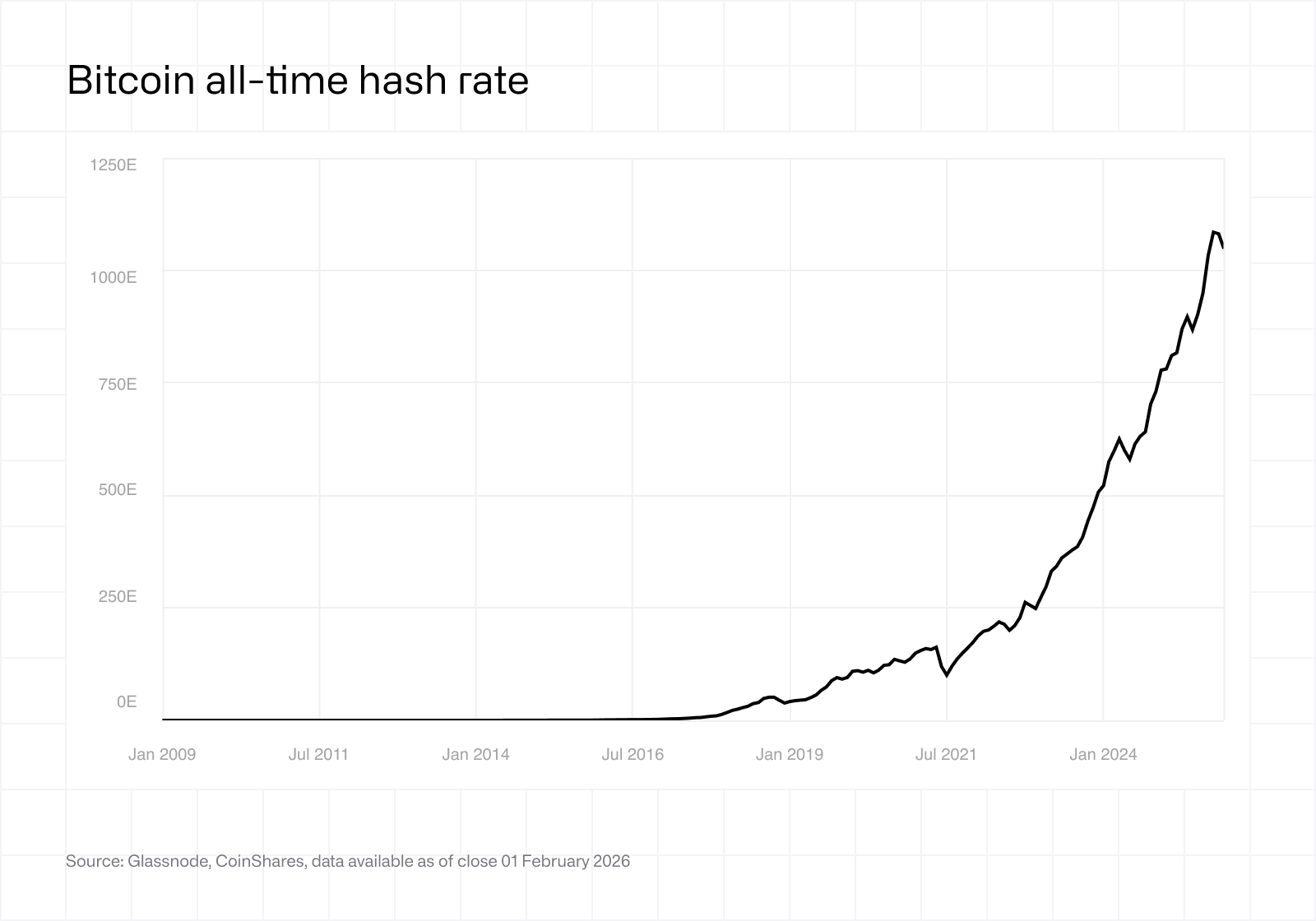

The energy expenditure for mining Bitcoin is referred to as the hashrate, and to compromise the network, an attacker would need to control 51% of this hashrate. Since its inception, the hashrate has continued to grow, as has the price of the underlying asset. A higher hashrate increases the difficulty of mining, making it increasingly challenging and costly to control 51% of the network.

A study titled 'Breaking BFT: Quantifying the Cost to Attack Bitcoin and Ethereum,' published in March 2024, estimated that launching an attack on Bitcoin would require between $5.6 billion and $20 billion to acquire the necessary hardware (excluding potential supply chain challenges). Additionally, electricity costs for just one hour of such an attack would range between $1.1 million and $7.8 million.

How do miners earn revenue?

Miners earn revenue in two ways:

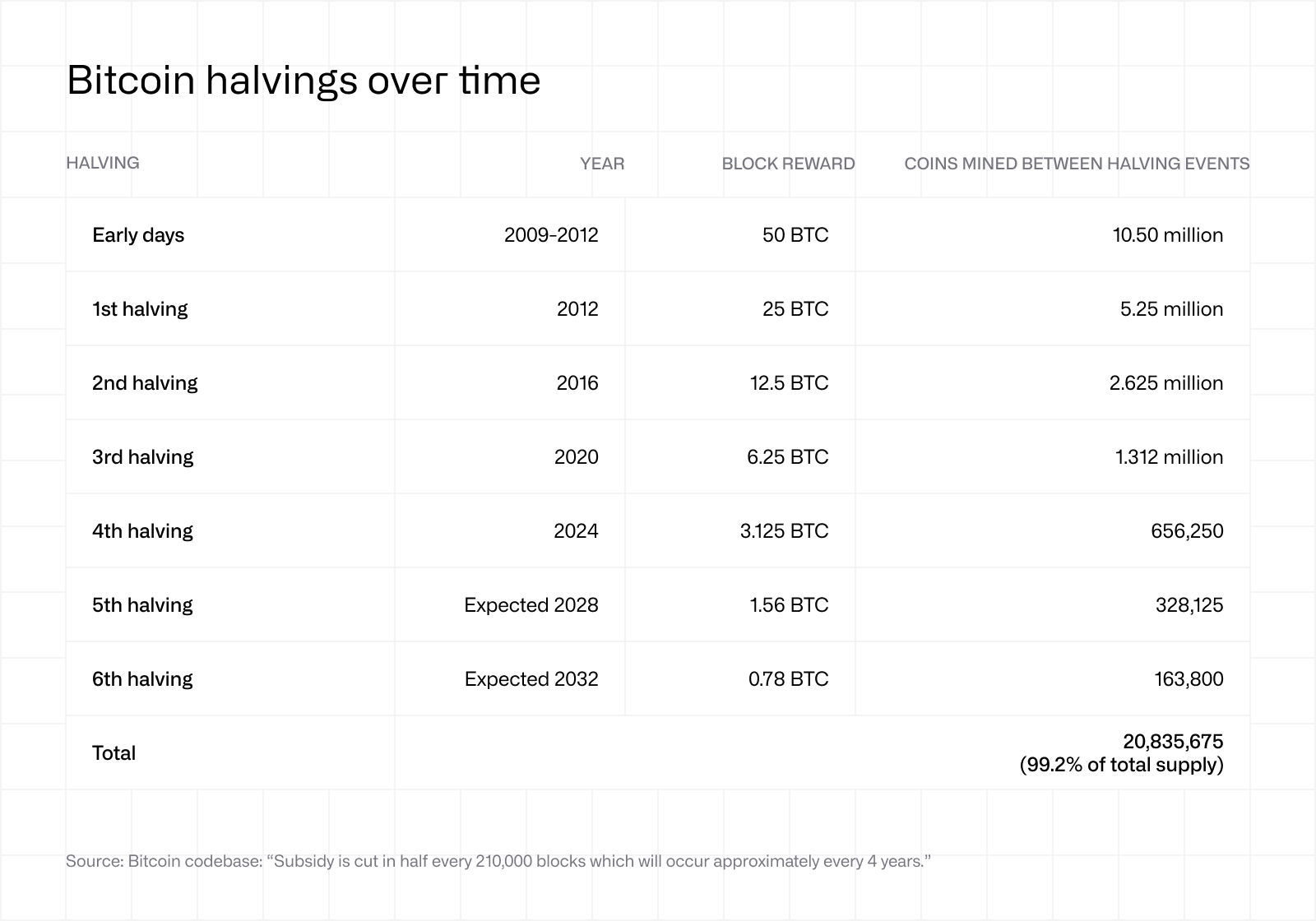

Block rewards: New bitcoins are issued as a reward for validating blocks. The reward started at 50 BTC per block and halves roughly every four years. As of 2024, following the most recent halving, the reward stands at 3.125 BTC per block.

Transaction fees: Users pay small fees to ensure their transactions are processed. These fees become increasingly important as block rewards decrease over time, eventually, transaction fees will be miners' sole source of revenue.

Together, these incentives drive the global mining ecosystem and ensure the network remains active and robust.

What is Bitcoin halving?

Approximately every four years (or every 210,000 blocks), the Bitcoin protocol automatically cuts the block reward in half. This event, called the “halving”, is fundamental to Bitcoin's monetary policy and its fixed supply cap of 21 million coins.

The halving schedule: 2009 (50 BTC), 2012 (25 BTC), 2016 (12.5 BTC), 2020 (6.25 BTC), 2024 (3.125 BTC). The next halving is expected around 2028, reducing the reward to 1.5625 BTC.

The cumulative effect of repeated halvings forms a geometric series that converges on Bitcoin’s fixed supply of 21 million coins or 2.1 quadrillion satoshis.

Once the final reward subsidy drops to zero, expected sometime around the year 2140, no more new bitcoins will ever be created. At that point, miners will be compensated solely through transaction fees. Halvings have historically preceded significant price appreciation, as reduced new supply meets steady or growing demand. However, they also squeeze miner margins, operators with higher costs may become unprofitable after a halving event.

This design ensures absolute scarcity, unlike fiat currencies that can be inflated at will, Bitcoin’s issuance cannot exceed the 21 million cap without rewriting the protocol’s fundamental rules. Rewriting Bitcoin’s layer one rules would require overwhelming consensus across the entire network.

Is Bitcoin mining profitable?

Mining can be lucrative if well-optimised, but profitability isn't guaranteed. Key factors that influence a miner's bottom line include:

Bitcoin price: Higher prices increase the fiat value of block rewards. A doubling of Bitcoin's price doubles revenue (in fiat terms) for the same mining output.

Electricity costs: Mining requires substantial energy. Low-cost power—ideally below $0.05 per kWh—is essential for competitive operations. This is why miners gravitate toward regions with cheap hydroelectric, natural gas, or stranded energy.

Hardware efficiency: Modern mining machines (ASICs) are far more powerful and energy-efficient than earlier models. Staying competitive requires regular hardware upgrades, which demands significant capital expenditure.

Network difficulty: Bitcoin automatically adjusts mining difficulty to ensure blocks are added roughly every 10 minutes. As more miners join the network, competition increases and individual profits thin out. Inversely, if miners leave the network, for instance, because of bankruptcy, network difficulty decreases.

Below here’s an estimation of profitability of different mining rigs based on a average electricity price of $0.05/kWh.

Why does mining matter for the bitcoin network?

Bitcoin was designed to be trustless: a system where no single party needs to be trusted. Mining plays a critical role in achieving this:

Security: The cost of attacking the network would far outweigh any potential gain, making the blockchain highly resistant to manipulation. To reverse transactions, an attacker would need to control over 50% of global mining power, an astronomically expensive proposition.

Decentralisation: With thousands of miners operating globally across dozens of countries, no single actor can easily take control of the network.

Aligned incentives: Miners are motivated by the potential to earn bitcoin, creating natural alignment between network security and individual profit. They're economically incentivised to follow the rules.

The important thing to remember is that the more miners there are, the more secure the bitcoin network is (and the more difficult it is to mine bitcoin).

Who are the major mining companies?

Bitcoin mining has evolved from hobbyists with laptops to an industrial-scale operation dominated by publicly traded companies. Major players include Marathon Digital Holdings, Riot Platforms, CleanSpark, and Core Scientific in the United States, along with international operators like Bitfarms and Hut 8.

US publicly-listed miners now account for over a third of global hashrate (total network computing power). These companies operate massive data centres, often in regions with cheap electricity, favourable regulatory environments, and cold climates to reduce cooling costs.

The industry has also seen significant consolidation, with larger operators acquiring distressed competitors, particularly after halvings squeeze margins on less efficient operations.

Additionally, Bitcoin mining is shifting toward a broader class of participants, including intermittent and modular miners using sites developed for other purposes, and even nations.

Can individuals still mine bitcoin?

In Bitcoin's early days, anyone with a laptop could mine profitably, since as explained above, mining difficulty was low due to the lack of participants. Those days are long gone.

Today, the barriers to entry for individual miners are substantial: ASIC machines cost thousands of pounds and constantly evolve; home electricity prices are typically too high to compete; and setting up and maintaining mining hardware requires specialised knowledge.

Some retail participants join mining pools (combining resources with others to share rewards) or gain exposure through public mining stocks and crypto-focused investment products like ETPs. These offer a way to benefit from mining economics without operating hardware directly.

There is still something called ‘hobby mining,’ carried out by participants willing to try their luck or simply to contribute to the network hash rate, with no expectation of profitability.

What is the environmental impact of bitcoin mining?

Bitcoin mining's energy consumption has drawn significant attention. The network consumes roughly as much electricity as some mid-sized countries: estimates range from 100-150 TWh annually. Yet, the energy mix matters more than total consumption. Industry surveys suggest around 50-60% of Bitcoin mining uses renewable or low-carbon energy sources. Miners are economically incentivised to seek the cheapest power, which increasingly means renewables like hydroelectric, solar, and wind or capturing otherwise-wasted energy like flared natural gas.

The carbon intensity of Bitcoin mining varies significantly by region due to differences in energy sources. Historically, much of the network's emissions originated from fossil fuel-heavy regions, but this is evolving. Additionally, Bitcoin mining has enabled oil producers to repurpose flared gas, reducing harmful emissions and offering a more sustainable energy solution by monetizing this otherwise wasted byproduct.

Bitcoin mining also serves as a catalyst for improving electrical grids. Miners support new energy projects by purchasing power directly from poorly connected or new generation sources, providing revenue to help scale and expand grid infrastructure. This accelerates the development of power generation in areas that might otherwise struggle to attract investment.

Miners' unique ability to power up or down with precision allows them to adjust energy consumption based on grid demand. When demand exceeds supply, miners reduce operations, freeing electricity for critical needs like hospitals or residential areas. This flexibility supports grid stability, enables power plants to operate more consistently, and increases total power supply during peak demand, all without requiring government subsidies or intervention.

Critics counter that any energy use for mining represents an opportunity cost. This debate continues to evolve as the industry's energy practices mature.

Where is Bitcoin Mining Legal or Restricted?

Current Bitcoin mining landscape is shaped as much by geography and regulation as by technology. With only about 450 new bitcoins added to circulation each day, the margins for miners hinge on access to cheap power, stable infrastructure and favorable policy.

Locations that combine these elements have become magnets for industrial-scale operations, while others push mining out through bans or strict regulation.

Countries Supporting Mining

America continent leads (USA, Canada, Paraguay)

The United States is the world’s largest hub for Bitcoin mining, with Texas leading through its deregulated power grid, abundant renewables and openness to flared-gas capture, while the Pacific Northwest provides hydro resources for a diverse energy mix.

Canada benefits from vast hydropower resources in provinces like Québec, Manitoba and British Columbia, alongside a cool climate that reduces cooling costs and extends hardware life. While Québec has capped the amount of electricity available to miners, the country still offers competitive energy prices and a transparent regulatory framework. This mix provides miners with operational stability, though large-scale expansion depends on regional energy policies.

Paraguay is emerging as a Latin American hub for mining thanks to surplus renewable energy from the Itaipú Dam, one of the world’s largest hydroelectric facilities. While the country generates more power than it consumes, the national utility ANDE maintains monopoly control and requires miners to negotiate special contracts or pay surcharges.

This adds complexity to operations, but Paraguay’s abundant, low-carbon electricity still gives it a strong environmental advantage.

Kazakhstan: Coal, Hydropower, and Mixed Fortunes

Kazakhstan rose to prominence after China’s 2021 mining ban, at one point hosting nearly a fifth of the global hashrate. Abundant coal power and initially permissive policies drew miners in, but grid instability, new electricity taxes, and stricter licensing have eroded its appeal. According to various sources1, Kazakhstan’s share has settled between 2 and 13% by 2025,, a sharp drop from its peak but still substantial. The country illustrates how quickly favorable conditions can reverse when infrastructure and regulation shift.

Countries with Bitcoin mining restrictions or bans

China, Iran, Malaysia: the grey zone

Once home to more than 60% of global mining power, China effectively removed itself from the industry in 2021 with a sweeping ban on large-scale mining. This triggered a migration of miners to North America, Central Asia and Russia. Yet, the mining operations have rebounded in 2025, according to reports2. Iran once promoted mining as a way to monetise excess energy, offering subsidised electricity and issuing licenses. However, recurring blackouts and pressure on the national grid have led authorities to impose seasonal bans and sudden shutdowns. The result is an unpredictable environment where miners face cycles of approvals followed by restrictions, limiting Iran’s ability to attract stable large-scale investment.

Malaysia allows mining but treats it as taxable income under the country’s standard corporate and progressive tax system. This framework can cut into profitability for smaller operators, while larger miners still benefit from relatively affordable power.

Some facilities have drawn scrutiny for unlicensed electricity use, yet Malaysia remains more open than countries with outright bans, positioning taxation as its primary control mechanism.

Emerging hubs strengthening the global bitcoin mining landscape

United Arab Emirates (UAE), Ethiopia

By 2025, the UAE has emerged as a strategic player in sovereign-held Bitcoin. Through Citadel Mining, a facility funded by the Abu Dhabi royal family's International Holding Company and built on Al Reem Island in just six months, the UAE had already mined as of August 2025 an estimated 9,300 BTC3, of which around 6,333 BTC are held in government-controlled wallets.

In Africa, Ethiopian Electric Power (EEP) tapped into excess hydropower to generate $55 million in revenue over a 10-month period in 2024 by selling this surplus energy to Bitcoin miners, according to a BBC report4. Initially hailed as a promising expansion of Ethiopia's energy monetization, to the tune of 2.25% of the global hashrate and $200 million in short-term earnings, EEP has since halted new crypto mining power permits but authorised participants are allowed to operate.

How regulation shapes mining

Energy availability is essential, but by itself it does not determine mining success. Clear and consistent regulation is now just as critical. Countries such as the US and Canada have attracted institutional-scale investment by providing transparent rules and property rights. In contrast, the uncertain policies in Kazakhstan, recurring restrictions in Iran, and outright prohibitions in China or Algeria show how instability pushes miners to relocate.

The global trend is unmistakable: Bitcoin mining flourishes in environments where low-cost energy meets regulatory clarity. When either element is absent, miners redirect their machines to jurisdictions offering a more secure foundation for long-term operations.

What Bitcoin mining means for investors

Understanding mining helps investors grasp what gives Bitcoin its durability as a digital asset. The security model, supply schedule, and economic incentives that mining creates are fundamental to Bitcoin's value proposition.

Mining economics also affect Bitcoin's price dynamics. After halvings, reduced new supply meets the same demand, historically a bullish catalyst. Miner behaviour (accumulating versus selling) can signal market sentiment. And mining difficulty adjustments ensure the network remains stable regardless of price fluctuations.

Another part often overlooked when it comes to Bitcoin mining is that it provides another way to get exposure to the emergence of artificial intelligence infrastructure as Bitcoin miners increasingly make use of their computing resources to power data centres whenever it is more profitable than mining bitcoin. As written by our Equity Analyst Alexander Schmidt in our latest Outlook, “building and fitting facilities to receive HPC (High performance computing) load is highly attractive to Bitcoin miners: it diversifies their businesses into a more stable, predictable and higher margin (3x on a per MW basis) revenue stream.”

Key Takeaways

Mining secures the Bitcoin network through proof-of-work consensus

Miners earn block rewards (currently 3.125 BTC) plus transaction fees

The halving reduces new supply every four years, affecting miner economics and potentially prices

Profitability depends on Bitcoin price, electricity costs, hardware efficiency, and network difficulty

US public miners now represent over a third of global hashrate

Individual mining is largely impractical

Most gain exposure through mining stocks or ETPs

1 Kazakhstan Joins Global Crypto Race, Yahoo Finance, September 2025

2 Bitcoin mining: China rebounds, Reuters, November 2025

3 UAE Has $700M in Bitcoin from Mining, Arkham Intelligence, August 2025

4 Ethiopia's Bitcoin Haven - BBC News, Focus on Africa, October 2025

Introduction to crypto

Crypto in the real world

Crypto investment options

Strategies and practical tips