Digital asset fund flows | August 25th 2025

2 min read

- Data

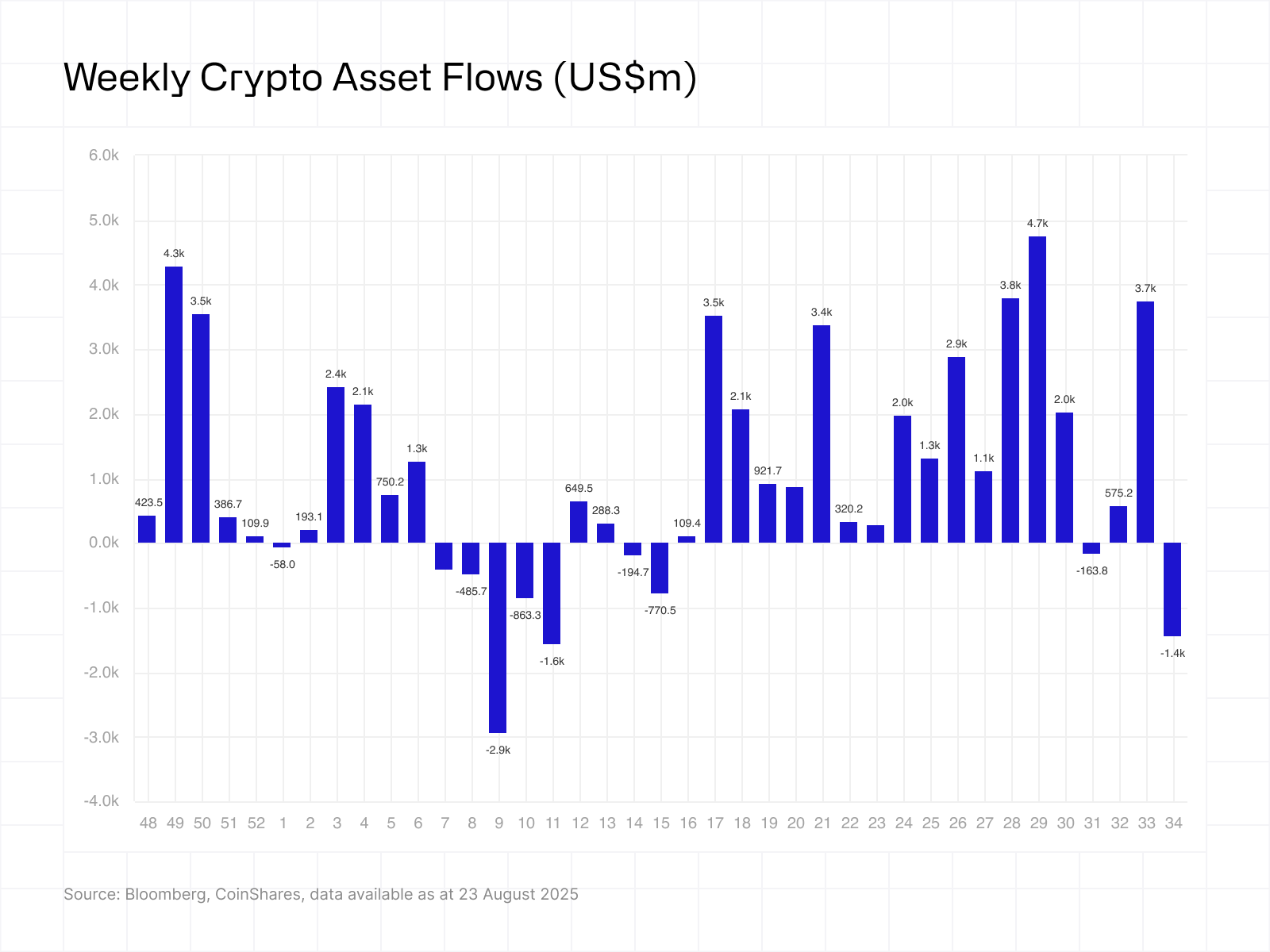

Fears over FED action prompt largest outflows since March of US$1.43bn

Digital asset investment products saw US$1.43bn in outflows, the largest since March, with ETP trading volumes surging to US$38bn.

Bitcoin recorded US$1bn in outflows, while Ethereum showed resilience with only US$440m out, driving month-to-date inflows of US$2.5bn versus Bitcoin’s US$1bn net outflows.

Altcoin flows were mixed: XRP (+US$25m), Solana (+US$12m), and Cronos (+US$4.4m) gained, while Sui (-US$12.9m) and Ton (-US$1.5m) suffered losses.

Digital asset investment products recorded their first significant outflows in weeks, totalling US$1.43bn, the largest since March. Trading volumes in ETPs reached US$38bn last week, about 50% above this year’s average, as investor sentiment became increasingly polarised over US monetary policy. Early in the week, pessimism around the Federal Reserve’s stance drove outflows of US$2bn. However, sentiment shifted later in the week following Jerome Powell’s address at the Jackson Hole Symposium, which was widely interpreted as more dovish than expected, sparking inflows of US$594m.

This shift in tone was more strongly reflected in Ethereum than in Bitcoin. Ethereum saw a sharp mid-week recovery, limiting outflows to US$440m compared to Bitcoin’s US$1bn. Month-to-date figures now show inflows of US$2.5bn into Ethereum, while Bitcoin has experienced net outflows of US$1bn, marking a notable change in investor sentiment toward the two assets. Inflows year-to-date for Ethereum represent 26% of total assets under management compared to just 11% for Bitcoin.

A wide selection of altcoins saw inflows, most notable being XRP (US$25m), Solana (US$12m) and Cronos (US$4.4m). While Sui and Ton suffered the most with outflows of US$12.9m and US$1.5m respectively.