Bitcoin’s role in an investment portfolio

7 min read

- Finance

- Bitcoin

Conventional wisdom is that bitcoin has had great returns but it does that by adding substantial risk (volatility) to a traditional equity/bond portfolio.

However, our research has found that:

Small weightings of bitcoin have an outsized positive impact on risk-adjusted returns and diversification relative to other alternative assets.

Bitcoin’s lack of correlation to other assets make it a useful alternative asset that can help reduce exposure to economic cycles.

Quarterly adjustments (rebalancing) of Bitcoin, back to the original weight in the portfolio can help limit volatility and enhance returns.

Bitcoin’s journey over the last decade has been well documented, with supporters and sceptics alike jostling to comment on the price of the world’s largest public blockchain. For investors with long-term investment horizons, however, a fundamental question remains largely unanswered: what is the effect of including bitcoin in an investment portfolio?

We believe thorough analysis of how Bitcoin performs in a typical 60/40 equity/bond portfolio is necessary to determine if it genuinely enhances or detracts from overall performance and diversification.

The analysis we carried out highlights that Bitcoin not only enhances returns, but also increases diversification regardless of when an investor decided to invest.

The Effect of Bitcoin on an Investment Portfolio - The Data

To test how bitcoin would help or hinder a portfolio we created a database of daily returns starting from 2015 when it was first financialised (available as an ETP). We created a traditional balanced portfolio with 60% equities and 40% bonds and then added a modest amount of bitcoin, detracting from both equities and bonds equally.

As bitcoin is an asset in an early growth phase, most investors would allow its portfolio weight to drift to some extent. We decided to rebalance on a quarterly basis, despite its potential hindrance on enhancing returns, because we believe rebalancing helps moderate volatility.

Bitcoin Improves Investment Portfolio Performance

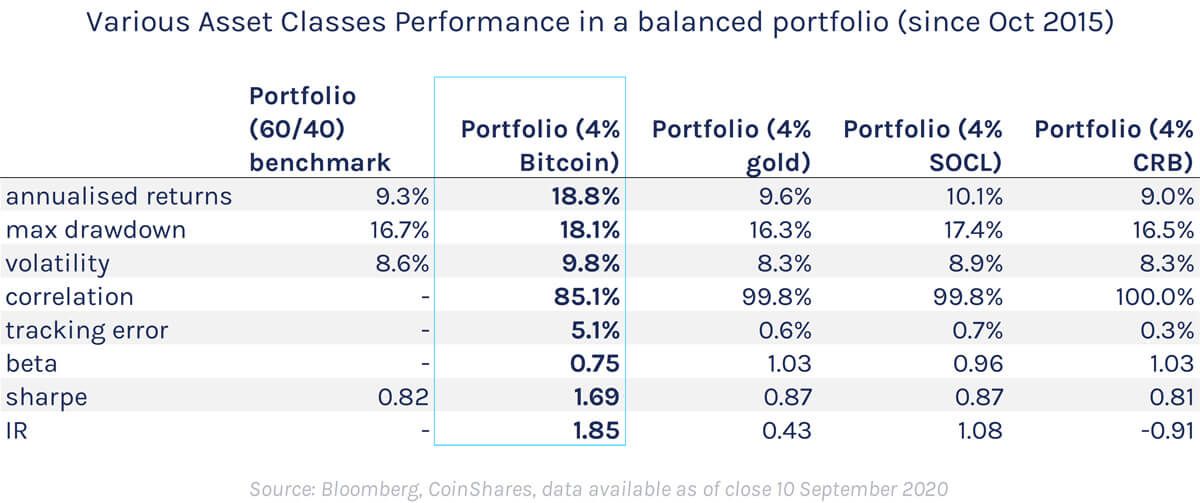

Despite bitcoin’s volatility, an allocation of 4% to the aforementioned portfolio improved annualised returns from 9.3% to 18.8%.

The Sharpe ratio of an investment portfolio tells us how good or bad returns have been relative to the risk taken on by the investor. Usually, any Sharpe ratio above 1 is considered to have a positive impact on a portfolio.

In this case we see a Sharpe ratio of 1.69 while the correlation to the base portfolio falls significantly by 15%:

Bitcoin Performance vs Various Asset Classes in a Portfolio

Bitcoin has been a diversifier for the standard 60/40 portfolio over the last three years. But, there are other alternative assets that might be used as diversifiers. We sought to understand how bitcoin has performed against these other alternatives.

We included in our analysis:

Gold due to bitcoin being often likened digital gold.

The SOCL index, a social networking index (including companies such as Facebook and Google) as bitcoin has been more closely correlated to this equity index than others in recent years.

Finally, the CRB index, a representative indicator of today’s global commodity markets due to its similarities to commodities.

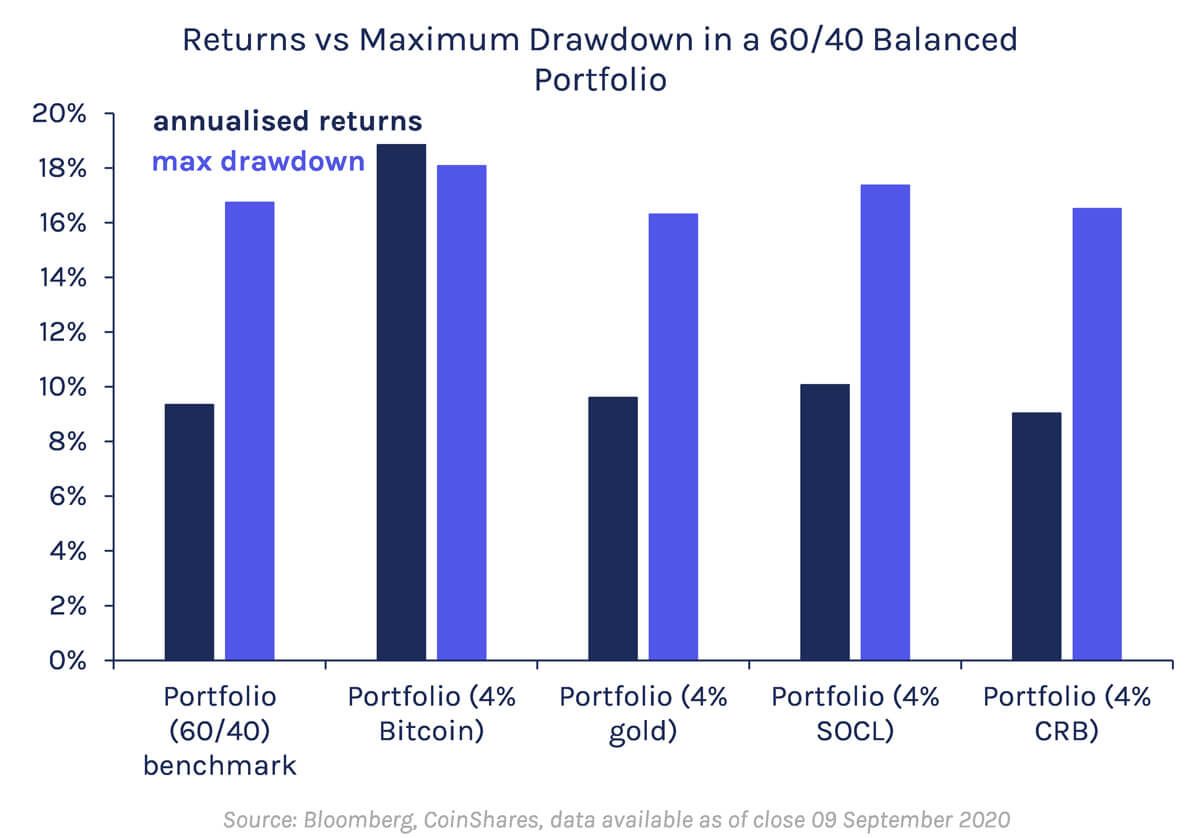

What is striking, is that over the same period none of the other comparable assets or indices offer the same diversification benefits. What also makes bitcoin stand out is its asymmetric return profile, that is, the upside it provided versus the downside. Despite bitcoin’s volatility, a 4% portfolio weighting does not materially increase the maximum drawdowns (i.e. the maximum possible loss from peak to trough) relative to other assets, while its annualised returns are close to double that of the other alternatives.

The backward-looking problem

A main weakness of this type of analysis is that it is backward-looking. Investments are likely to perform and behave differently in the future than they have in the past. This could be particularly relevant as we argue that bitcoin’s identity is steadily changing.

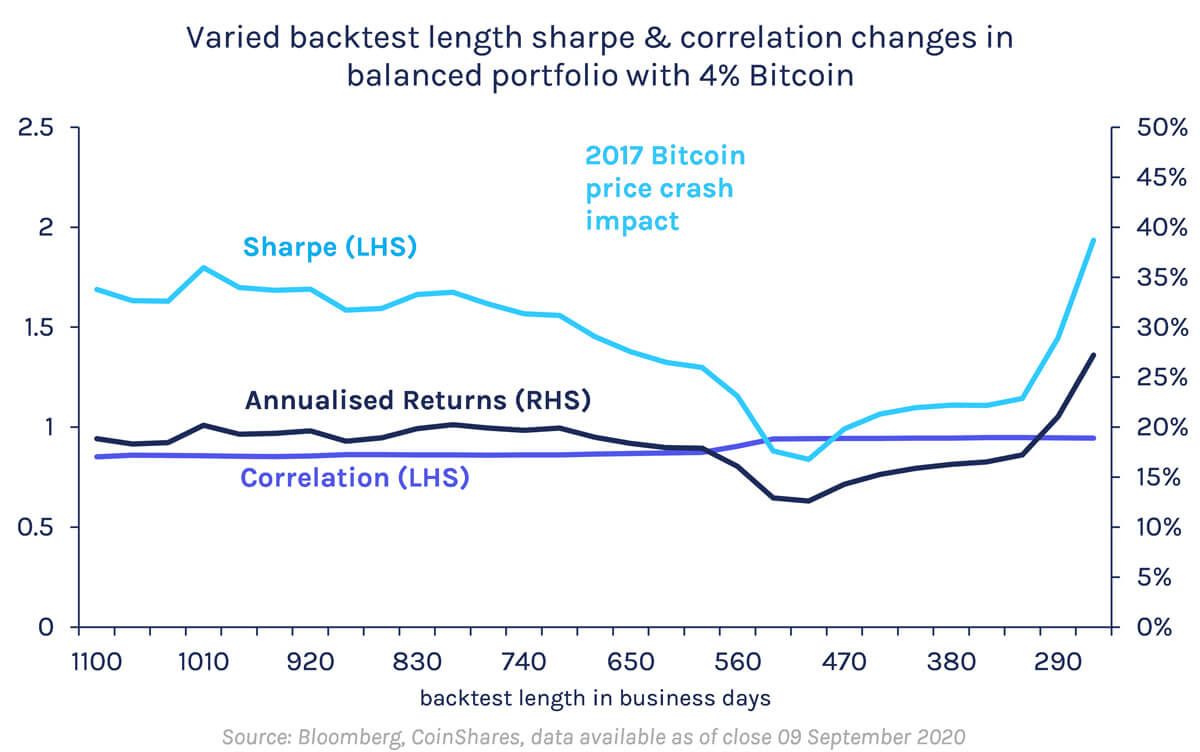

This does not mean we should dismiss this analysis. The chart below means we can see what effect Bitcoin would have had on our portfolio regardless of an investor’s entry point. For example, a backtest length of 675 days would mean an investor decided to add bitcoin to the portfolio around the time it reached nearly 20,000 USD in late 2017.

The chart highlights varied backtest lengths, from 290 days on the right through to 1100 days on the left. We are encouraged to see that correlation of a bitcoin portfolio relative to the standard 60/40 equities/bond portfolio remains consistently lower than comparable assets such as gold or commodities, highlighting that bitcoin is a much better portfolio diversifier. Bitcoin’s consistency is also significant. Even through exceptionally volatile periods for bitcoin, its correlation and annualised returns have remained remarkably consistent.

Bitcoin as an Effective Portfolio Diversifier

Interestingly, even if bitcoin was added to a portfolio at peak, in December 2017, when prices fell dramatically, it would still enhance portfolio returns with a reduced, but significantly better Sharpe ratio, relative to other portfolio diversifiers such as gold or commodities. From the peak in December 2017, Bitcoin returns are currently -46% it should therefore detract from the overall portfolio Sharpe ratio. Historically, this has been mitigated by quarterly rebalancing (returning the Bitcoin weight in the portfolio back to its original), helping limit the impact of Bitcoin volatility. We see similar results from monthly rebalancing, suggesting regular rebalancing has been an effective approach to moderate overall portfolio volatility.

In conclusion, bitcoin’s investment characteristics have historically made it attractive both as a driver of returns and a portfolio diversifier. Compared to other common alternatives and diversifiers, bitcoin delivers outsized positive impacts on returns, Sharpe ratio and diversification, even at very low allocation sizes.

Given these benefits, bitcoin may well be suited to fill the current gap in available diversifiers troubling investors and portfolio allocators, as well as help reduce the exposure to economic cycles.

Disclosure

The information contained in this document is for general information only. Nothing in this document should be interpreted as constituting an offer of (or any solicitation in connection with) any investment products or services by any member of the CoinShares Group where it may be illegal to do so. Access to any investment products or services of the CoinShares Group is in all cases subject to the applicable laws and regulations relating thereto.

This document is directed at professional and institutional investors. Investments may go up or down in value and you may lose some or all of the amount invested. Past performance is not necessarily a guide to future performance. This document contains historical data. Historical performance is not an indication of future performance and investments may go up and down in value. You cannot invest directly in an index. Fees and expenses have not been included.

Although produced with reasonable care and skill, no representation should be taken as having been given that this document is an exhaustive analysis of all of the considerations which its subject-matter may give rise to.This document fairly represents the opinions and sentiments of CoinShares, as at the date of its issuance but it should be noted that such opinions and sentiments may be revised from time to time, for example in light of experience and further developments, and this document may not necessarily be updated to reflect the same.

The information presented in this document has been developed internally and / or obtained from sources believed to be reliable; however, CoinShares does not guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions and other information contained in this document are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Third party data providers make no warranties or representation of any kind in relation to the use of any of their data in this document. CoinShares does not accept any liability whatsoever for any direct, indirect or consequential loss arising from any use of this document or its contents.

Any forward-looking statements speak only as of the date they are made, and CoinShares assumes no duty to, and does not undertake, to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Nothing within this document constitutes (or should be construed as being) investment, legal, tax or other advice. This document should not be used as the basis for any investment decision(s) which a reader thereof may be considering. Any potential investor in digital assets, even if experienced and affluent, is strongly recommended to seek independent financial advice upon the merits of the same in the context of their own unique circumstances.

CoinShares Capital Markets (UK) Limited is an appointed representative of Strata Global Ltd. which is authorised and regulated by the Financial Conduct Authority (FRN 563834).The address of CoinShares Capital Markets (UK) Limited is Octagon Point, 5 Cheapside, St. Paul’s, London, EC2V 6AA.

The CoinShares Astronaut is a trademark and service mark of CoinShares (Holdings) Limited.

Copyright © 2020 CoinShares