Inflation-linked bitcoin?

3 min read

The market expects longer term inflation rise, though short term evidence is inconclusive.

Gold has gone through ‘seasons’ in its relationship to core inflation. We expect bitcoin may do the same.

Gold has shown itself to be more a safe-haven for surprise inflation. This too may be a role that bitcoin plays in the future.

Fears of Rising Inflation Have Arguably Risen to Levels Not Seen This Century

Traditionally, inflation linked securities such as TIPS (Treasury Inflation-Protected Securities) and gold have been the go-to assets when investors are looking for protection. Recently, we’ve seen such fears reflected in increasing levels of investments into Inflation protected ETPs (Exchange Traded Products). Only since June this year there have been inflows of US$8.1bn, the highest since records began.

This inflationary fear has also prompted investors to flock to safe havens such as gold where prices have risen to record highs. So far, there is very little concrete evidence to point to any increases in price inflation. Consumer prices indices (CPI) have fallen since the COVID crisis began, and only recovered slightly. A significant issue with the CPI is that its data is lagging.Instead, investors have been focussing on more forward-looking indicators such as input prices and prices charged. IHS Markit publishes this data for the US and it highlights that input prices have risen for most sectors, who are then passing on these costs to their customers as indicated by prices charged. We believe this, combined with COVID related government stimulus, is what is stoking investor fears of inflation.

Gold Has a Reputation as an Inflation Hedge, but This Is a Tenuous Link

During the 1970’s gold performed well as a hedge during a period of aggressive inflation. During the 1980’s and 1990’s where inflation was restrained, gold’s correlation was much less pronounced.In fact, when grouped in 10-year lots it becomes clear that its inflation tracking ability has varied significantly over the decades, creating several distinct correlation clusters over the four periods between 1973 and 2013.

Whilst we believe it is possible that bitcoin’s price performance could also show a positive long-term correlation to inflation, there simply hasn’t been enough price history to support this thesis yet. Also, given its similarities to gold, it shouldn’t surprise us to find that bitcoin’s relationship to inflation may be similarly tenuous.

Early Signs that Bitcoin Has Links with Inflation

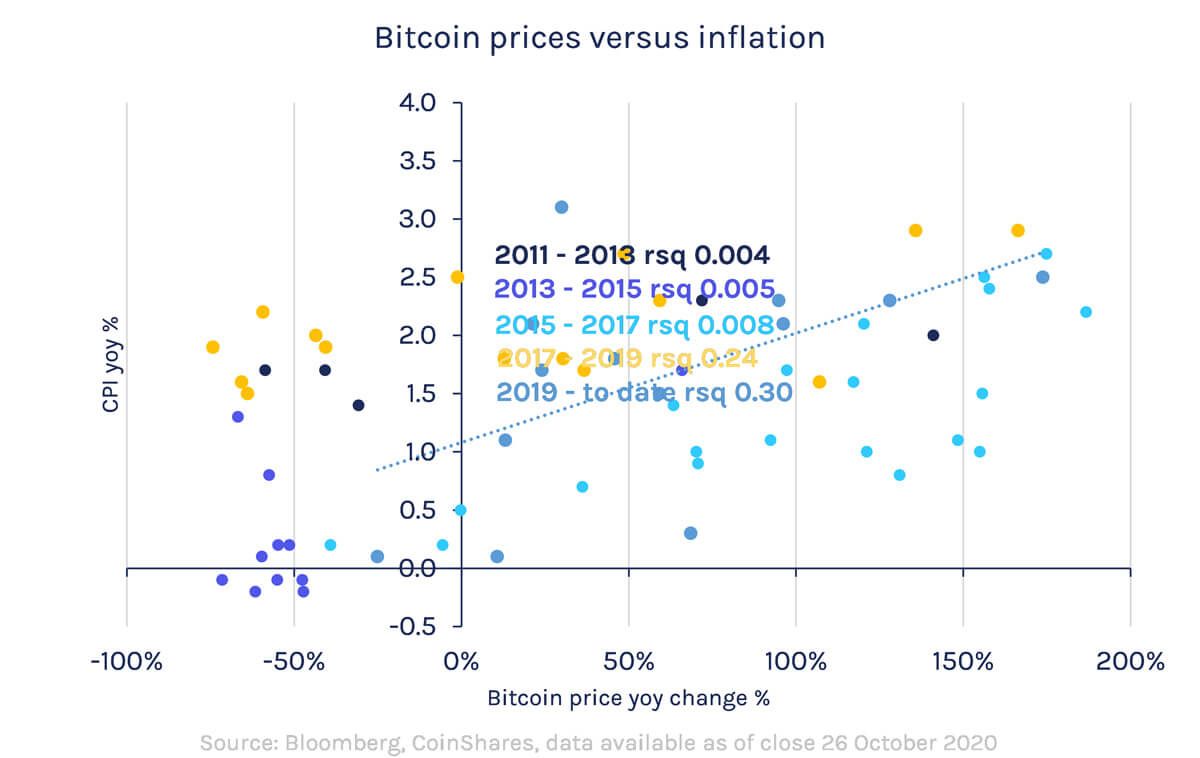

Given the limited historical data, we are not able to group bitcoin’s price performance into more than a single 10-year period. The alternative is to observe over two-year periods to understand how its relationship to inflation is changing. Over the last year we have observed a slightly improved relationship between bitcoin’s price performance and inflation, but we are hesitant to draw any conclusions until we are able to work with significantly larger sample sizes.

An early observation to make is that Bitcoin’s relationship with inflation since 2017 has been improving as it started being used as a store of value. Because of its characteristics (scarcity, liquidity, high uptime), evidence suggests investors are increasingly using it as a store of value, the very features that theoretically help protect from inflation and debasement of fiat money supply.It is important to highlight that this is unlikely to detract from its other compelling functions such as digital ownership, security, providing immutable and traceable records as well as programmable money.

Unexpected Inflation

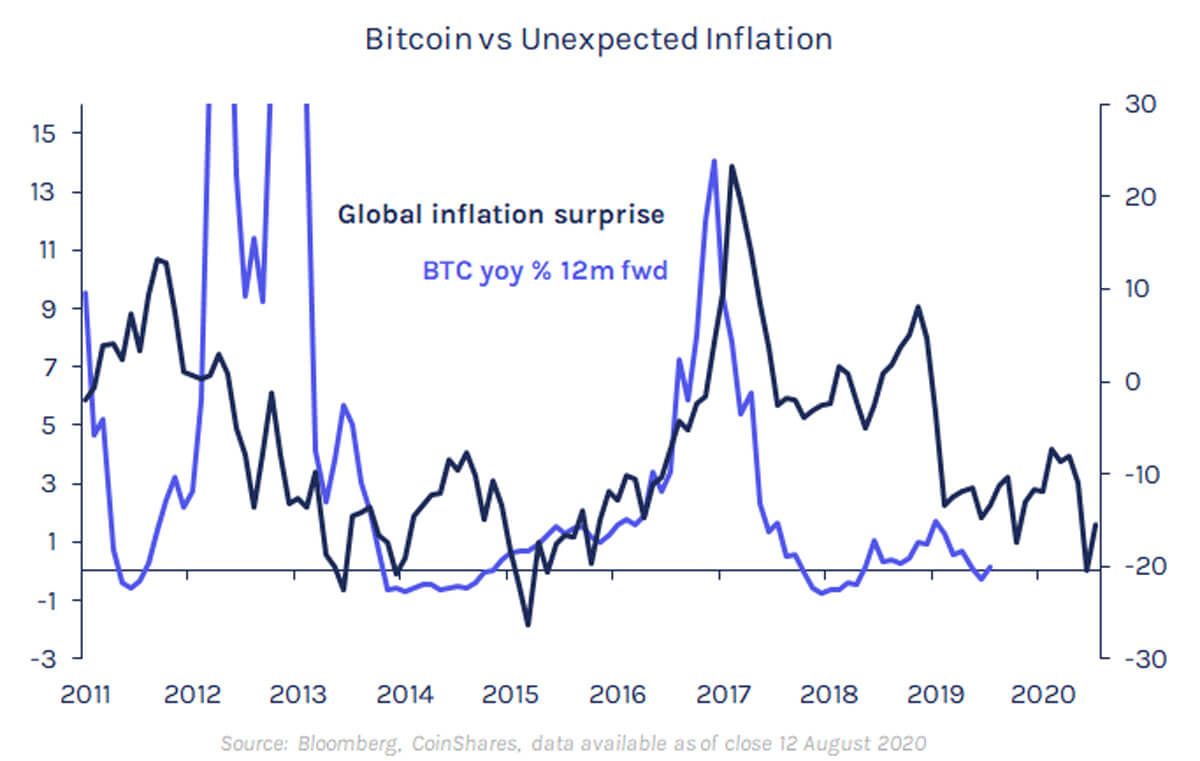

Gold shows a better relationship with unexpected inflation. Citi compiles an index that tracks unexpected or ‘surprise’ inflation, by measuring inflation forecasts versus delivered results (see chart below).

At levels above zero inflation is higher than expected. Bitcoin also has an early but potentially compelling relationship with unexpected inflation. Our analysis highlights that bitcoin does appear to react to unexpected inflation, rising when delivered inflation figures are higher than expectations.

We appreciate that bitcoin’s relationship with inflation is most likely inconclusive at this juncture as the sample size is low. That said, it is interesting to note that as time has progressed, this relationship has been steadily improving.

It's an early signal, but we intend to keep tracking it and will continue to share our findings as investors begin to dig deeper into the digital asset class.