Digital asset fund flows | November 24th, 2025

2 min read

- Data

High outflows of US$1.9B, although tentative sighs of a turn in sentiment

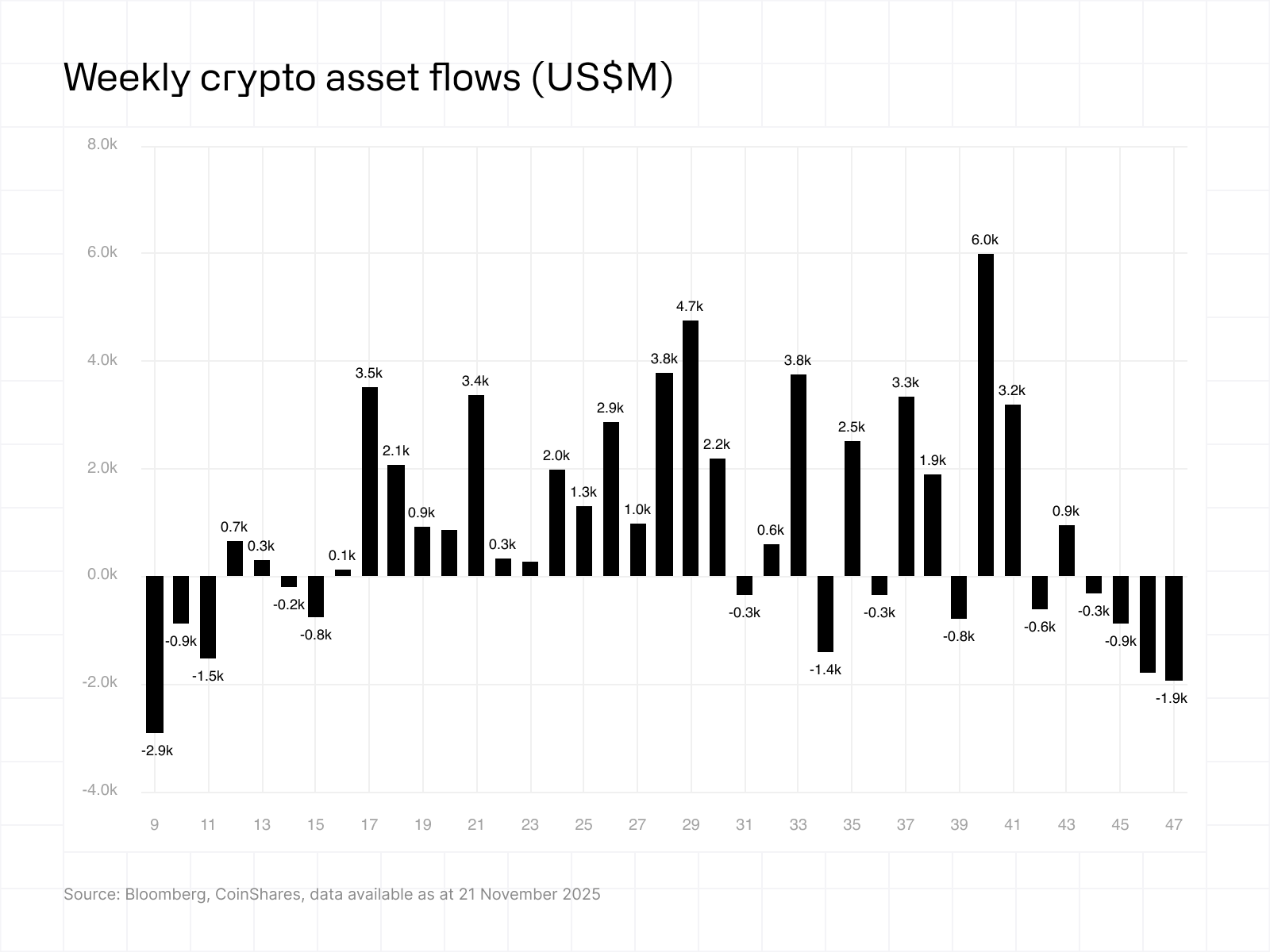

Digital asset investment products saw US$1.94B of outflows last week, bringing the four-week total to US$4.92B, the third largest outflow run since 2018.

Bitcoin and Ethereum led the outflows, although both showed signs of recovery on Friday, while Short Bitcoin continued to see strong inflows.

Among altcoins, Solana recorded US$156M of outflows, while XRP bucked the trend with US$89.3M of inflows.

Digital asset investment products saw outflows totalling US1.94B, marking the 4th consecutive week of outflows now totalling US$4.92B, representing 2.9% of total assets under management (AuM). Proportionally this represents the 3rd largest run of outflows since 2018, beaten only by March 2025 and February 2018, marking a 36% decline in AuM representing the combined impact of inflows and price. Despite this, total inflows this year so far remain high at US$44.4B.

The final trading day of last week signalled tentative signs of a turnaround in sentiment with minor inflows of US$258M following 7 consecutive days of outflows.

Bitcoin saw the majority of outflows totalling US$1.27B last week but also saw the largest rebound on Friday with US$225M inflows. Short Bitcoin remains popular, seeing US$19M inflows, and has seen inflows of US$40m over the last 3 weeks representing 23% of AuM, seeing its AuM rise an astonishing 119%.

Bitcoin saw the majority of outflows totalling US$1.27B last week but also saw the largest rebound on Friday with US$225M inflows. Short Bitcoin remains popular, seeing US$19M inflows, and has seen inflows of US$40m over the last 3 weeks representing 23% of AuM, seeing its AuM rise an astonishing 119%.

Ethereum saw outflows totalling US$589M. having suffered more over the last week with outflows representing 7.3% of AuM, it too staged a minor recovery on Friday with inflows of US$57.5M. Solana saw outflows of US$156M, while XRP bucked the trend with inflows of US$89.3M last week.